The Class 12 Economic Additional Practice Questions Paper 2023-24 for all students of Class 12 has been released by the Central Board of Secondary Education. The official website to download and practice the Class 12 Economic Additional Practice Questions Paper 2023-24 (CBSE) is www.cbseacademic.nic.in. The students appearing in the Class 12th examination can now download the Economics Practice Paper and start their preparation for the board examination. These practice papers will help the students in their revision and will also help in understanding the newly updated format of the actual Board exam pattern. We have mentioned the direct link to download the CBSE Class 12th Economics Additional Practice Paper in the article below.

CBSE Class 12 Economics Additional Practice Question Paper 2023-24

The CBSE Class 12 Additional Practice Paper 2023-24 with the latest updated format of the actual exam has been released by the Central Board of Secondary Education. All these Additional practice papers consist of the entire syllabus of Class 12th. The interesting fact about the CBSE Class 12 exams 2024 is that the question paper will consist of 50% of the competitive questions. The CBSE Class 12 Additional Practice Question Paper 2023-24 provides an overview of the actual board exam question paper pattern including the number of sections, number of questions, type of question (Multiple choice, Very short, Short answer, Long answers), time duration, and overall structure of the actual examination. The Economics Practice Question Paper contains two sections:

Section A – Macro Economics

Section B – Indian Economic Development

- There will be 20 multiple-choice questions carrying 01 mark each.

- 04 Short answer questions carrying 03 marks each, and these questions are to be answered in 60-80 words.

- 06 Short answer questions carrying 04 marks each, answers to these questions must be given in 80-100 words.

- 04 Long answer questions carrying 06 marks each, answers to these questions must contain 100-150 words.

Class 12 Economics Additional Practice Paper Pdf

The student can now download the CBSE Class 12 Economics Additional Practice Question Paper PDF with the answer key and marking scheme. The students must practice this practice paper as it will help to familiarize themselves with the actual exam pattern. Here we have mentioned a direct link for downloading the Class 12 Economics Practice Paper pdf with the solution pdf.

| Class 12 Economics Additional Practice Question Paper 2023-24 | |

| Additional Practice Question Paper Pdf | Solution Pdf |

| Class 12 Economics Practice Paper 2023-24 | Solution Link |

Economics Additional Practice Question Paper 2023-24

Here we have discussed the entire CBSE Class 12 Economics Additional Practice Paper 2023-24 with solutions below.

Section A – Macro Economics

Q1. Read the following statements carefully:

Statement 1: The level of consumption has a direct impact on the amount of savings the households can accumulate over time.

Statement 2: Higher consumption often leads to lower savings, while lower consumption tends to facilitate higher levels of savings.

In light of the given statements, choose the correct alternative from the following:

a) Statement 1 is true and Statement 2 is false.

b) Statement 1 is false and Statement 2 is true.

c) Both Statements 1 and 2 are true.

d) Both Statements 1 and 2 are false.

Answer: c) Both Statements 1 and 2 are true.

Q2. The scenario which would lead to an increase in GDP, but might not necessarily improve overall welfare?

a) Reduction in income inequality

b) Rapid growth of the financial sector

c) Expansion of environmentally harmful industries

d) Increased government investment in education and healthcare

Answer: c) Expansion of environmentally harmful industries.

Q3. If the government implements a tax cut and people use most of their extra money to increase their consumption, this suggest about the MPC that:

a) It is not applicable in this situation

b) It is low, indicating people prefer saving over spending

c) It is negative, indicating people are decreasing their consumption

d) It is high, indicating people are responsive to changes in income

Answer. d) It is high, indicating people are responsive to changes in income.

Q4. A positive balance in the Capital Account of the Balance of Payments of a country indicates that:

a) trade balance is positive

b) Currency is depreciating

c) It is experiencing a budget surplus

d) It is receiving more foreign investments than it is making abroad

Answer: d) It is receiving more foreign investments than it is making abroad.

Q5. In the web of financial interactions, when individuals harmoniously enter into agreements to honor the repayment of a loan at a designated point in the future, they are engaging in which pivotal function of money:

a) a safe place to keep the wealth

b) a tool that helps to compare the value of different things

c) a bridge between people who want to buy things and people who want to sell things

d) a steady foundation that helps to agree on how to settle debts or loans at a later time

Answer: d) A steady foundation that helps to agree on how to settle debts or loans at a later time.

Q6. Punjab National Bank receives a deposit of 80,000 and the reserve requirement is 10%. If the bank decides to hold reserves equal to 20% of the deposit instead of the required amount, how much excess reserve does the bank hold?

a) 4,000

b) 8,000

c) 12,000

d) 16,000

Answer: b) 8,000

Q7. The interaction between the concept of the price level and the dynamics of aggregate demand in an economy is interconnected as:

a) the price level increases, aggregate demand increases

b) the price level increases, aggregate demand decreases

c) changes in the price level have no impact on aggregate demand

d) the relationship between the price level and aggregate demand is unpredictable.

Answer: b) the price level increases, aggregate demand decreases.

Q8. The influence exerted by international borrowing on the foreign exchange supply within an economy is indicated when it:

a) minimally affects the supply of foreign exchange

b) tends to diminish the supply of foreign exchange

c) intends to increase the supply of foreign exchange

d) confined solely to alterations in the supply of domestic currency.

Answer: b) tends to diminish the supply of foreign exchange.

Q9. Given an economy with a Consumption Function of C = 750 + 0.5Y, where C represents Consumption Expenditure, Y represents National Income, and an Investment Expenditure of 2,300, what would be the Consumption Expenditure at the equilibrium level?

a) 1,400

b) 6,100

c) 3,050

d) 3,800

Answer: d) 3,800 [Solution AS=AD Y= C+I => Y= 750 + 0.5 Y + I => Y – 0.5 Y = 750 + 2,300 => 0.5 Y = 3,050 => Y = 3,050/ 0.5 = 6,100 C = 750+ 0.5 ( 6,100) = 750 + 3,050 = 3,800 ]

Q10. Which of the following best defines ‘Unilateral Transfers’ in the context of international transactions?

a) Funds transferred internationally as loans for a specified tenure and interest rate.

b) Trade transactions involving goods and services between two countries.

c) Payments made by one party without expecting any return in the future.

d) Investments made by a country in the stock market of another country.

Answer: c)

Q11. Elucidate the distinction between Autonomous Items and Accommodating Items concerning a nation’s Balance of

Payments. Give examples to demonstrate the country’s international economic interactions.

Answer:

| Basis | Autonomous Items | Accommodating Items |

| Meaning | Autonomous items refer to items that take place due to some economic reasons such as profit maximization. | Accommodating items refer to those items that are undertaken to cover deficit or surplus in autonomous transactions i.e. these are the results of the autonomous transaction. |

| Effect On BOP | Autonomous transactions are independent of the state of the BOP account. | Accommodating transactions are undertaken to maintain the balance in the BOP account. |

| Examples | These items are also known as “above-the-line items”. For example: Remittances from Indians Abroad and the export of Intellectual Properties. | These items are also known as “below-the-line items”. For example: Receiving Foreign Aid and foreign Exchange Reserves Accumulation. |

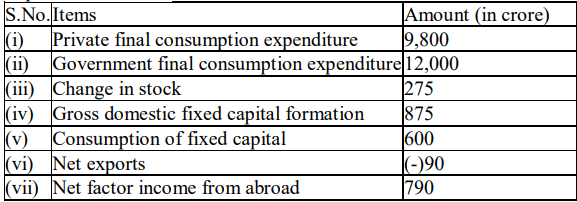

Q12. (A) Calculate Gross Domestic Product at market price using the Expenditure method:

OR

(B) Explain the concept of Double Counting in the context of calculating National Income and provide a practical way to avoid it.

Answer: (A) Using the Expenditure Method, GDP at MP = Private final consumption expenditure + Government final consumption expenditure + Gross domestic capital formation (Gross domestic fixed capital formation + Change in stock) + Net exports = 9,800 + 12,000 +275 +875 + (-)90 crores = 22,860 crores.

OR

(B) Double counting is a critical issue that arises in the calculation of national income when certain economic activities or transactions are counted multiple times, leading to an inflated estimation of the country’s total income. This distortion can result in an inaccurate representation of the actual economic output and may mislead policymakers and analysts. The practical way to avoid double counting when calculating national income is the value-added approach: By focusing on the value added at each stage of

production, we avoid counting the value of intermediate goods multiple times. For example, consider the production of a smartphone. Instead of counting the value of raw materials, components, and final assembly, focus on the value added by each stage of the production process, which is the actual contribution to the national income.

Q13. If the National Income is 250 crore and Savings are 80 crore, find out the Average Propensity to Consume. When National Income rises to 390 crore and Savings to 115 crore, what will be the Average Propensity to Consume and the Marginal Propensity to Save?

Answer: If National income is 250 crores and savings 80 crore, then Consumption = 170 crores.

APC= C/Y=170/250= 0.68

If National Income increases to 390 crores and Savings to 115 crores, then Consumption = 275 crores.

APC= C/Y=275/390= 0.70

MPS= Change in Savings / Change in Income= 35/140=0.25

Change in Savings= 115-80=35

Change in Income = 390-250=140.

Q14. (A) Describe the economic scenario when ex-post Aggregate Demand surpasses ex-post Aggregate Supply and its potential consequences on price levels, production, and employment.

OR

(B) Demonstrate your understanding of how the Reserve Bank of India can apply monetary policy tools to tackle a scenario of Deficient Demand in the economy. Identify and discuss four specific measures that the Reserve Bank of India can employ to effectively correct the situation.

Answer: (A) When ex-post Aggregate Demand exceeds ex-post Aggregate Supply in an economy, it results in a situation where the total demand for goods and services exceeds the economy’s capacity to produce them in the short run.

Consequences:

1. Price Increases: With more demand than supply, businesses may raise prices to balance the limited availability of goods and services. This can lead to a general increase in the overall price level, contributing to inflation.

2. Shortages: As production struggles to meet high demand, shortages of goods can occur, potentially leading to dissatisfaction among consumers and creating a seller’s market.

3. Increased Employment: To meet the heightened demand, businesses might need to increase their production, potentially leading to increased hiring and lower unemployment rates.

OR

(B) To address a scenario of deficient demand in the economy, the Reserve Bank of India can utilize various monetary policy tools. Here are four specific measures that the RBI can employ to effectively correct the situation:

1. Lowering the Repo Rate: The RBI can lower the repo rate, which is the rate at which it lends money to commercial banks. By reducing the repo rate, borrowing becomes cheaper for banks, leading to a subsequent decrease in lending rates for consumers and businesses. This encourages increased borrowing and spending, which boosts economic activity and helps counteract deficient demand.

2. Open Market Operations: The RBI can conduct open market operations by buying government securities from the market. When the RBI purchases these securities, it injects money into the banking system, increasing the liquidity available to banks. As a result, banks are better equipped to extend loans to individuals and businesses, thereby stimulating demand and economic growth.

3. Cash Reserve Ratio Reduction: The RBI can opt to lower the Cash Reserve Ratio, which is the percentage of bank deposits that banks are required to maintain with the central bank. By reducing the CRR, banks have more funds at their disposal for lending and investment. This move can encourage increased credit flow to various sectors of the economy, leading to higher consumer spending and investment, ultimately addressing the issue of deficient demand.

4. Special Liquidity Facilities: In times of deficient demand, the RBI can introduce special liquidity facilities to provide direct funding support to sectors facing liquidity crunches.

Q15. Explore four main functions of the Reserve Bank of India and how each of these functions contributes to the overall growth of the Indian economy.

Answer: The following are the four main functions of the Reserve Bank of India contributing to the overall growth of the Indian economy:

1. Banker to the Government: The RBI acts as the banker to the central and state governments. It manages their accounts, provides banking services, and facilitates the issuance and redemption of government securities. By efficiently managing government finances and public debt, the RBI helps maintain fiscal discipline and ensures that the government can meet its expenditure requirements without causing excessive inflation or crowding out private investment.

2. Issuer and Manager of Currency: The RBI has the sole authority to issue currency notes and coins in India. It manages the supply of currency to meet the transactional needs of the economy and ensures the availability of genuine and secure currency. An adequate supply of genuine currency facilitates smooth transactions and promotes trust in the monetary system.

3. Banker’s Bank and Lender of Last Resort: It provides various banking services to them and acts as a lender of last resort to ensure financial stability in times of crisis. RBI helps maintain stability in the financial system and ensures that banks can meet their obligations and continue to provide credit to businesses and individuals.

4. Foreign Exchange Management: It intervenes in the foreign exchange market to stabilize the value of the Indian rupee against other major currencies. A stable exchange rate also helps in controlling inflation by keeping import costs in check.

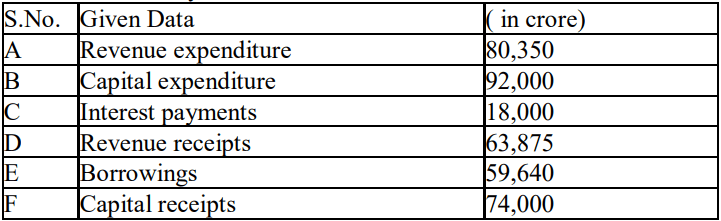

Q16. (A). Utilizing the provided data, compute Revenue Deficit, Fiscal Deficit, and Primary Deficit:

(B) Outline a hypothetical scenario where a government is considering implementing a new tax policy. In this scenario, explain how the introduction of a Progressive Tax would affect individuals with low, middle, and high incomes.

OR

(C) Explain the Government’s Budget and its various sources of revenue. Present three actual instances of non-tax revenue earnings that a government could accumulate during its fiscal year.

(D). Highlight three main objectives that guide the government to frame its policies and decisions. Explain these three objectives providing examples.

Answer: (A). Solution

1. Revenue Deficit = Revenue expenditure – Revenue receipts

= 80,350 crore – 63,875 crore = 16,475 crore

2. Fiscal deficit = Borrowings = 59,640 crore

3. Primary Deficit = Fiscal deficit – Interest payments

= 59,640 crore – 18,000 crore = 41,640 crore

(B). Progressive Tax: Under the proposed progressive tax system, individuals with higher incomes would pay a larger percentage of their income in taxes. The tax rates would increase as income levels rise.

• Low-Income Individuals: Low-income earners such as entry-level workers and those with minimum-wage jobs would experience relief. The progressive tax would impose lower tax rates on their income, allowing them to retain a larger portion of their earnings. This approach would help alleviate their financial burden and improve their disposable

income.

• Middle-Income Individuals: The middle class, comprising professionals, managers, and small business owners, would likely

experience a moderate increase in their tax liability. As their incomes fall within the mid-range, they would face slightly higher tax rates compared to the low-income group. However, the government could implement tax brackets that mitigate excessive burdens on this segment of the population.

• High-Income Individuals: Affluent citizens, including top executives, investors, and wealthy entrepreneurs, would face a substantial increase in their tax obligations. The progressive tax system would subject their higher incomes to progressively higher tax rates. While this approach aims to redistribute wealth and fund social programs, it might lead to debates regarding tax fairness and potential incentives for tax evasion or avoidance.

OR

(C). The citizens should know the complexities of the government’s budget and the sources of revenue it relies on. One important component of the government’s revenue is non-tax revenue receipts. Non-tax revenue receipts refer to the income that the government generates from sources other than taxes.

Three examples of non-tax revenue receipts that a government might have in its fiscal year are:

1. Income from State-Owned Enterprises: The profits and dividends earned from these state-owned enterprises contribute to the non-tax revenue receipts of the government.

2. Fees and Charges for Government Services: Governments provide a wide range of services to citizens and businesses, such as issuing licenses, permits, and certificates. They may also charge fees for services like passport issuance and vehicle registration. These fees and charges represent non-tax revenue for the government.

3. Interest and Dividends: Governments invest in various bonds, stocks or deposits and earn interest or receive dividends from these investments. These earnings contribute to the non-tax revenue receipts.

(D). The main objectives that guide the government’s policies and decisions are as follows:

1. Economic Growth and Job Creation: It is one of the primary objectives of the government. This objective involves implementing policies that encourage investments and promote innovation in various sectors. For example, the government may provide tax incentives to businesses, invest in infrastructure projects, and develop programs to upskill the workforce.

2. Social Welfare and Poverty Alleviation: This objective encompasses the implementation of social welfare programs that provide financial assistance, healthcare, education, and housing support to disadvantaged populations. For instance, the government may offer cash transfers, subsidized healthcare services, and affordable housing schemes to uplift the living standards of those in need.

3. Balanced regional growth: Governments play a pivotal role in enhancing the country’s infrastructure and planning of urban areas for efficient and sustainable growth. Governments invest in transportation, energy, and communication infrastructure to facilitate economic development and improve citizens’ quality of life.

Q17. (a). In the estimation of a country’s National Income, are the following items included? Provide reasons for each.

(i) Rent-free house to an employee by an employer

(ii) Purchases by foreign tourists

(iii) Purchase of a truck to carry goods by a production unit

(b). Elaborate on the concepts of Nominal Gross National Product and Real Gross National Product with examples to illustrate the significance of these measures in economic decision-making.

Answer: (a). Reasoning:

(i) Rent-free house to an employee by an employer: No, it is not included in the estimation of a country’s National Income. It is considered a non-monetary benefit and is not counted in the National Income calculation.

(ii) Purchases by foreign tourists: Yes, it is included in the estimation of a country’s National Income. These purchases generate revenue for local businesses and are considered a part of the country’s gross domestic product which is a key component of the National Income calculation.

(iii) Purchase of a truck to carry goods by a production unit: Yes, it is included in the estimation of a country’s National Income. This transaction represents investment in capital goods, which adds value to the production process and contributes to the country’s economic output.

(b). Let’s dive into the definitions and real-life examples to understand their significance in economic decision-making.

1. Nominal Gross National Product: It is the total monetary value of all final goods and services produced by the residents of a country within a specific time period, usually a year, without adjusting for inflation. Real-Life Example: In a particular year, its Nominal GNP is calculated to be 500 crores. However, during the same year, the prices of goods and services across the country

increased due to inflation by 5%. This means the Nominal GNP includes the effect of higher prices, which can distort the true picture of economic growth.

2. Real Gross National Product: It is the total monetary value of all final goods and services produced by the residents of a country within a specific time period, adjusted for inflation. Real-Life Example: Let’s assume the adjusted Real GNP is 475 crores. This figure accounts for the inflation effect and provides a more accurate representation of the country’s economic growth, helping economists and policymakers assess the true changes in economic output.

Section B – Indian Economic Development

Q18.The overarching objective of equitable distribution goals in planning is to:

a) ensure a fair and just society for all citizens.

b) foster competition by reducing government intervention in markets.

c) focus on short-term gains rather than long-term societal benefits.

d) enhance economic growth through targeted investments in specific sectors.

Answer: a) ensure a fair and just society for all citizens.

Q19: The main objective of China’s One Child Policy, which was implemented from 1979 to 2016 was:

a) to provide financial incentives for families with multiple children.

b) to promote gender equality by limiting the number of male children.

c) to control population growth and address overpopulation concerns.

d) to encourage families to have more children and increase the population.

Answer: c) to control the population growth and address overpopulation concerns.

Q20. Due to increasing expenses related to energy and ecological considerations, a country chose to make significant investments in domestic renewable energy technologies instead of bringing in traditional energy sources from abroad.

What favorable outcomes can be anticipated from this strategy of substituting imports?

I: lower energy costs for consumers due to subsidized imports

II: promotion of the domestic green energy sector through targeted investments

III: enhanced self-sufficiency in energy production and greater sustainability

IV: increased dependence on foreign technology for renewable energy implementation

Alternatives:

a) I and II

b) II and III

c) III and IV

d) IV and I

Answer: b) II and III

Q21. A farmer Chandu practices organic farming and uses crop rotation and natural predators to control pests.

Is there an advantage of this approach provided as compared to conventional pesticide use?

a) faster and predictable pest eradication

b)lower labor costs for pest management

c) increased risk of crop failure and reduced yields

d) reduced harm to beneficial insects and pollinators

Answer: d) reduced harm to beneficial insects and pollinators.

Q22. Read the following statements: Assertion (A) and Reason (R). Choose the correct alternative from those given below.

Assertion (A): The industrial sector reforms implemented under liberalization policies in a country led to an increase in Foreign Direct Investment in the manufacturing sector.

Reason (R): Liberalization policies aimed to toughen trade barriers, regulate industries, and provide a conducive environment for Indigenous investors, making the manufacturing sector more attractive for FDI.

Alternatives:

a) The Assertion (A) is true, but the Reason (R) is false.

b) The Assertion (A) is false, but the Reason (R) is true.

c) Both the Assertion (A) and Reason (R) are true, but the Reason (R) is not the correct explanation of the assertion.

d) Both the Assertion (A) and Reason (R) are true, and the Reason (R) is the correct explanation of the assertion.

Answer: a) The Assertion (A) is true, but the Reason (R) is false.

Q23. The multifaceted process of demographic transition within the context of India pertains to:

a) a sudden decline in the population growth rate due to migration.

b) a change in the population density across different states in India.

c) a significant increase in the birth rate and death rate simultaneously.

d) a shift from high birth and death rates to low birth and death rates over time.

Answer: d) a shift from high birth and death rates to low birth and death rates over time.

Q24. Select the option that presents a common challenge associated with sustainable aquaculture practices:

a) guaranteed financial gains

b) neutral impact on ecosystems

c) struggle to maintain ecological equilibrium

d) independent of technological advancements.

Answer: c) struggle to maintain ecological equilibrium.

Q25. In urban areas with high population density, the challenge which is often associated with housing and living conditions.

a) high homeownership rates, leading to limited rental options.

b) difficulty in accessing essential services due to congested living.

c) limited open spaces and recreational areas, affecting quality of life.

d) inadequate housing and overcrowding, leading to slum settlements.

Answer: d) inadequate housing and overcrowding, leading to slum settlements.

Q26. Read the following statements carefully:

Statement 1: Jobless growth has been a significant challenge in the Indian economy in recent years.

Statement 2: Despite witnessing economic growth, the Indian economy has been struggling to create sufficient employment opportunities to absorb the growing workforce.

In light of the given statements, choose the correct alternative from the following:

a) Statement 1 is true and Statement 2 is false.

b) Statement 1 is false and Statement 2 is true.

c) Both Statements 1 and 2 are true.

d) Both Statements 1 and 2 are false

Answer: c) Both Statements 1 and 2 are true.

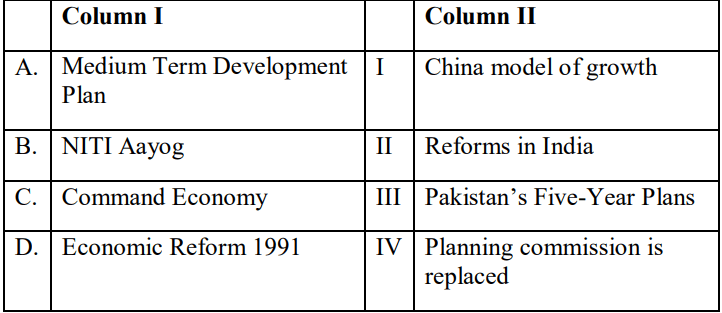

Q27. From the set of statements given in Column I and Column II, choose the correct pair of statements:

Alternatives:

(a) A-II, B-I, C-III, D-IV

(b) A-III, B-IV, C-I, D-II

(c) A-I, B-II, C-IV, D-III

(d) A-IV, B-III C-II, D-I

Answer: (b) A-III, B-IV, C-I, D-II

Q28. (A) Identify and briefly explain three key features of the Indian economy on the eve of independence that contributed to its

predominantly stagnant structure.

OR

(B) Describe three key features of India’s foreign trade on the eve of independence. Illustrate with examples the country’s trading patterns with other nations.

Answer: (A) Three key features of the Indian economy on the eve of independence, that contributed to its predominantly stagnant structure:

1. Agricultural Dominance and Low Productivity: The Indian economy was primarily agrarian, with agriculture being the main occupation for a significant portion of the population. However, the agricultural sector suffered from low productivity due to traditional and outdated farming methods. Lack of modern agricultural technology, inadequate irrigation facilities, and fragmented land holdings limited economies of scale, resulting in stagnant agricultural output and perpetuating rural poverty.

2. Colonial Economic Exploitation: The British colonial rule pursued economic policies that were designed to serve Britain’s interests at the expense of Indian development. India was primarily treated as a supplier of raw materials for British industries, while finished goods were imported, leading to deindustrialization. The drain of wealth from India through heavy taxation and

unequal trade policies hindered the growth of domestic industries and stifled economic progress.

3. Limited Industrialization and Infrastructure: The Indian economy lacked significant industrialization on the eve of independence. The lack of domestic industries and a weak manufacturing base limited employment opportunities outside the agricultural sector. Additionally, inadequate infrastructure, including transportation and communication networks, hampered the efficient movement of goods and services, restricting market integration and economic growth.

OR

(B) On the eve of independence in 1947, India’s foreign trade was characterized by several key features:

1. Dominance of British Trade Relations: The country’s trade was largely focused on exporting raw materials, such as cotton, jute, and tea to Britain and importing finished goods in return. This trade pattern resulted from the exploitative economic policies imposed by British colonial rule, which hindered India’s industrial development.

2. Limited Diversification of Trading Partners: India had limited trading partners outside the British Empire. The colonial rule discouraged India from actively engaging in trade with other countries, and the majority of its foreign trade was confined to British colonies. This lack of diversification in trading partners restricted India’s economic growth and hindered the development of a more dynamic foreign trade landscape.

3. Low Share of Industrial Exports: India’s foreign trade was characterized by a relatively low share of manufactured or industrial goods in its export basket. The economy was primarily agrarian, and the majority of exports consisted of primary agricultural commodities. This limited India’s ability to earn foreign exchange and hindered the development of a self-reliant industrial base.

Q29. Outline three sources of the development of human capital and provide instances of investments in human capital that can contribute positively to a nation’s economic expansion and overall well-being.

Answer: Human capital refers to the knowledge, skills and abilities possessed by individuals, which play a crucial role in driving economic growth and overall prosperity.

Here are the sources of human capital formation and instances of investments in these areas that can positively impact the country’s economic growth:

1. Education System: Developing and strengthening the education system is one of the primary sources of human capital formation. Building more schools, hiring qualified teachers, and improving the curriculum to ensure better access to education, resulting in a more skilled and productive workforce.

2. Vocational Training and Skill Development: Promoting and establishing vocational training centers to provide specialized skills training, leading to a more diverse and adaptable workforce with skills relevant to the changing job market.

3. Healthcare and Nutrition: A healthy and well-nourished population is more productive and can contribute significantly to economic growth. Investing in healthcare infrastructure and nutrition programs can improve the overall health and well-being of citizens, leading to higher workforce participation and productivity.

Q30. Enumerate four primary policy endeavors undertaken by the Chinese government subsequent to attaining independence, aimed at attaining economic advancement and industrialization. Illustrate the consequences of these approaches on its economic progress and evolution into a significant global economic force.

Answer: Four primary policy endeavors undertaken by the Chinese government to achieve economic advancement and industrialization are:

1. Economic Reforms and Opening-Up Policy: In 1978, China embarked on economic reforms and implemented the Opening-Up Policy under the leadership of Deng Xiaoping. This policy aimed to attract foreign investment, promote trade and encourage private entrepreneurship. The establishment of Special Economic Zones (SEZs) in cities like Shenzhen allowed foreign companies to invest and set up businesses in China, leading to a surge in foreign direct investment and technology transfer. This policy played a pivotal role in China’s rapid industrialization and economic growth.

2. Export-Led Growth: China adopted an export-oriented development strategy, focusing on manufacturing and exports. The country positioned itself as the “world’s factory,” leveraging its large labor force and low production costs. By becoming a major exporter of goods, such as electronics and machinery, China attracted foreign exchange and accelerated its economic growth, resulting in the lifting of millions of people out of poverty.

3. Infrastructure Development: The Chinese government invested heavily in infrastructure development, including transportation, energy, and communication networks. The implementation of projects like the high-speed rail networks exemplifies this strategy. Improved infrastructure not only enhanced connectivity and logistical efficiency but also boosted industrial production and facilitated regional development.

4. Human Capital Investment and Education: China prioritized investments in education and human capital formation. The country focused on providing access to primary and secondary education, vocational training, and higher education. The increase in the number of skilled workers and a growing knowledge-based workforce played a critical role in China’s technological

advancement and innovation, contributing to its rise as a global technological leader.

Q31. (A) Give a thorough analysis of four primary obstacles encountered by rural banking establishments when fostering financial inclusion and driving economic growth within a developing nation.

OR

(B) State four measures that a government in a developing country can implement to enhance the efficiency and effectiveness of the agricultural marketing system.

Answer: (A)Four primary obstacles encountered by rural banking establishments are:

1. Infrastructure and Connectivity: In rural areas, inadequate infrastructure and connectivity pose significant challenges for rural banks to reach remote and marginalized communities. Lack of proper roads, internet connectivity, and banking infrastructure hampers the establishment of physical bank branches and access to digital banking services.

2. Low Financial Literacy: Limited financial literacy among rural populations inhibits their understanding and usage of formal financial services. Many rural individuals are unfamiliar with banking products and services, leading to low adoption rates of banking services.

3. Inadequate Banking Products: Rural populations often have unique financial needs that may not be adequately addressed by standard banking products offered by urban-focused institutions.

4. Limited Access to Credit: Access to credit is vital for rural entrepreneurs and farmers to invest in their businesses and agricultural activities. However, stringent credit assessment processes, lack of collateral, and risk aversion from banks may limit credit availability to rural borrowers.

OR

(B) 1. Development of Market Infrastructure: The government invests in the development of modern market infrastructure, such as wholesale markets, cold storage facilities, and transportation networks. These initiatives aim to reduce post-harvest losses, improve supply chain efficiency, and ensure better price realization for farmers and producers.

2. Market Information Systems: Implementing a reliable and up-to-date market information system helps farmers make informed decisions about when, where, and at what price to sell their produce.

3. Price Support and Minimum Support Price (MSP) Schemes: The government implements price support mechanisms and MSP schemes to provide a guaranteed minimum price for certain agricultural commodities. This ensures that farmers receive remunerative prices and reduces market price volatility, encouraging agricultural production.

4. Farmer Cooperatives and Producer Organizations: Encouraging the formation of farmer cooperatives and producer organizations can strengthen the bargaining power of small-scale farmers. By pooling resources and collectively selling their produce, farmers can negotiate better prices with buyers and access larger markets that may have been challenging to reach individually.

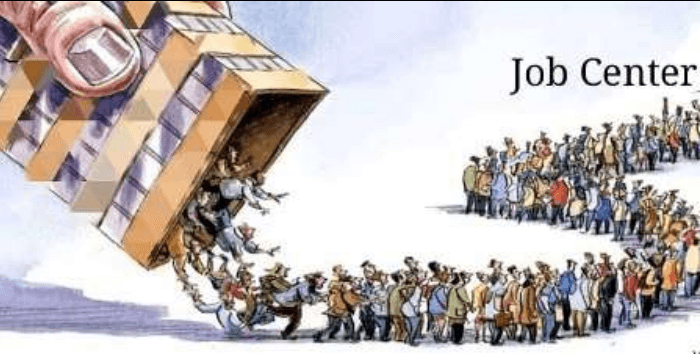

Q32. Identify the situation depicted in the given image. Categorize the three main causes of it in the country.

Source: LinkedIn, from an article by Emanuele Musa.

Answer: The picture depicts unemployment.

1. Inadequate Economic Growth: The slow growth fails to provide enough unemployment opportunities to the ever-increasing population. With the increase in population, the economy couldn’t keep up with the demands for employment and an increasing share of people is not able to find jobs. This results in insufficient levels of employment nationwide.

2. Increase in Population Rate: There is a prediction that India’s population will exceed China’s by the year 2024, it will further be the most populous country. Population growth couldn’t be matched by the economic growth of the country, which leads to the majority of society being unemployed.

3. Agriculture is a Seasonal Occupation: Only for certain months of the year, does agriculture provide employment to a huge segment of the population; which results in a considerable portion of the year, many agricultural workers lack needed employment and income.

Q33. (A). “Considering ‘Agricultural Subsidy as a Vice,’ analyzes three prominent negative implications stemming from agricultural subsidies associated with providing subsidies to farmers.

(B) Highlighting three significant adverse impacts, conduct a comprehensive analysis to evaluate the potential negative repercussions of implementing the economic strategy of Import Substitution in developing nations.

OR

(C) In order to understand the complexities of the industrial sector in India on the eve of independence, elaborate on the prevailing conditions that contributed to “Systematic de-industrialization” and technological backwardness.

(D) Analyze the complex challenges posed by India’s foreign trade situation on the eve of independence. Investigate the factors that led to the trade imbalances and dependence on imports during this period.

Answer: (A). The negative implications of providing subsidies to farmers under the context of “Agricultural Subsidy as a Vice,” are as follows:

1. Huge Burden on Government Finances: Agricultural subsidies can impose a substantial financial burden on government resources and public funds. Providing subsidies requires significant budget allocation, which may divert resources from other critical sectors such as health, education and infrastructure. The allocation of a large portion of the budget to subsidies can limit the government’s ability to address other pressing needs.

2. Misappropriated Benefits and Inequities: Agricultural subsidies may not always reach their intended beneficiaries and can lead to misappropriation and unequal distribution of benefits. Subsidies may be misused or diverted by middlemen, powerful interest groups, or large-scale farmers, leaving small and marginalized farmers with limited access to these benefits. This results in unequal distribution and exacerbates income disparities.

3. Wasteful Consumption and Overproduction: Agricultural subsidies can lead to wasteful consumption and overproduction, straining resources and market imbalances. Subsidies that reduce the cost of inputs such as water, fertilizers and energy can encourage their excessive use, leading to wastage and environmental degradation. Overproduction resulting from subsidies can cause market gluts and affect prices.

B). Import substitution is when a country tries to make things at home instead of buying them from other countries. It has some benefits but also some problems:

1. Missing out on world trade: If a country only makes things for itself, it might miss chances to sell things to other countries. This means it might not make as much money as it could.

2. Less competition, more costs: If a country doesn’t buy things from other countries, its own businesses might not try as hard to do a good job. This can mean things cost more and aren’t made as well.

3. Wasting resources: If a country tries to make everything itself, even things it’s not good at, it might not use its resources (like workers, materials, and money) as wisely as it could. This can make the whole economy less productive.

OR

(C). Systematic Deindustrialization during British Rule in India:

1. Decline of Indian courts: The disappearance of Indian courts struck the first blow at Indian handicrafts. As native states passed under British rule, the demand for fine articles, for display in durbars and other ceremonial occasions disappeared. The ordinary demand did continue for some time longer, but the younger generation lacked the means and inducement to patronize the arts and handicrafts and they declined.

2. Introduction of New Patterns: With the disappearance of Indian states, old rulers and nobles also disappeared and their place was taken up by the European Officers and tourists. Indian craftsmen, however, did not clearly understand the forms and patterns which suited European tastes. They tried to please their new customers by copying their forms and patterns.

3. Competition of Machine-Made Goods: Apart from the abolition of Indian courts and the introduction of foreign influences, it was the superior manufacturing technique based on power and improved machinery that enabled the British manufacturers to drive the Indian artisans from out of their home market.

(D). British rule in India brought an end to India’s foreign trade as India primarily became a net exporter of raw materials and importer of finished goods produced by British industry.

1. Net Exporter of Primary Products and Importer of Finished Goods- India under British rule became an exporter of raw materials (cotton, wool, indigo, etc.) and an importer of finished goods. The composition of exports and imports showed the backwardness of the economy.

2. Monopoly control of India’s Foreign Trade- The British government monopolized the exports and imports of the country in a way that, more than 50% trade with Britain only. Imports of Britain’s finished goods provided a huge market to British industry in India.

3. Surplus Trade but only to Benefit the British- Despite the exports exceeding our imports, there was mass export of primary goods which was a sign of economic backwardness. The trade surplus was used for the administrative and war expenses of the Britishers and not for the growth and development of the country.

Q34. Read the following passage on the causes of the environmental crisis and answer the questions that follow:

The world is facing an unprecedented environmental crisis characterized by various interconnected challenges. Several factors have contributed to this alarming situation, threatening the delicate balance of ecosystems and the well-being of both humans and wildlife. One of the primary causes of the environmental crisis is the rapid growth of the human population. The increasing demand for resources, food, and energy has led to extensive deforestation, habitat destruction, and overconsumption of natural resources.

Industrialization and modernization have played a significant role in exacerbating the environmental crisis. The reliance on fossil fuels and the emission of greenhouse gases has resulted in global warming and climate change, leading to extreme weather events, rising sea levels, and disruptions in natural cycles. The unchecked discharge of pollutants and waste from industries has further contaminated air, water, and soil, endangering human health and biodiversity.

Another critical factor contributing to the environmental crisis is the expansion of agriculture and urbanization. The conversion of forests and natural habitats into agricultural lands and urban areas has led to the loss of biodiversity and fragmentation of ecosystems. This has disrupted the natural habitats of numerous species, leading to the extinction of many plants and animal species.

Moreover, human activities such as irresponsible waste management and improper disposal of plastics have resulted in the accumulation of plastic waste in oceans and landfills, causing harm to marine life and contaminating the environment. The excessive use of chemical fertilizers and pesticides in agriculture has also led to soil degradation, water pollution, and loss of biodiversity.

The environmental crisis is a complex issue with various interconnected causes. The rapid growth of the human population, industrialization, urbanization, and irresponsible waste management practices are some of the major contributors to this crisis. Addressing these causes requires a collective effort from governments, industries, and individuals to adopt sustainable practices and promote environmental conservation.

Source from: National Institutes of Health, Mongabay, UNFCCC, Intergovernmental Panel on Climate Change

On the basis of the given text and common understanding, answer the following question:

(i). Elucidate the primary causes of the environmental crisis described in the passage.

(ii). Discuss the connection between industrialization and the ongoing environmental crisis.

(iii). Explain the impact of agriculture and urbanization on the environment.

Answer: (i). The primary causes of the environmental crisis described in the passage are:

a) Rapid growth of human population leading to extensive deforestation, habitat destruction, and overconsumption of natural resources.

b) Industrialization and modernization, which contribute to global warming and climate change through reliance on fossil fuels and emission of greenhouse gases.

c) Expansion of agriculture and urbanization, resulting in the loss of biodiversity and fragmentation of ecosystems.

d) Irresponsible waste management and improper disposal of plastics, leading to the accumulation of plastic waste in oceans and landfills, causing harm to marine life and contaminating the environment. The excessive use of chemical fertilizers and pesticides in agriculture also contributes to soil degradation, water pollution, and loss of biodiversity.

(ii). Industrialization has contributed to the environmental crisis in several ways:

a) Reliance on fossil fuels for energy production leads to the emission of greenhouse gases, which causes global warming and climate change.

b) The discharge of pollutants and waste from industries contaminates air, water, and soil, posing risks to human health and biodiversity.

(iii). The impact of agriculture and urbanization on the environment includes:

a) Conversion of forests and natural habitats into agricultural lands and urban areas disrupts ecosystems, leading to the loss of biodiversity and extinction of plant and animal species.

b) Agricultural practices, such as the excessive use of chemical fertilizers and pesticides, result in soil degradation, water pollution, and further loss of biodiversity.

CBSE Class 12 Chemistry Additional Pract...

CBSE Class 12 Chemistry Additional Pract...

CBSE Class 12 Business Studies Sample Qu...

CBSE Class 12 Business Studies Sample Qu...

CBSE Class 12 Physics Model Paper 2024-2...

CBSE Class 12 Physics Model Paper 2024-2...