The Central Board of Secondary Education has released the CBSE Class 12 Accountancy Additional Practice Question Paper 2023-24 at its official website i.e., https://cbseacademic.nic.in/. The Class 12th students are informed that from this session, there will be no term-wise exams. All the students preparing for the Class 12th Accountancy exam must download the CBSE Class 12 Additional Practice Papers 2023-24 and are advised to go through the practice papers thoroughly. As practicing these Additional Practice papers will help the students understand the pattern of the upcoming actual CBSE Class 12th Accountancy Exam 2024. Here we have discussed the whole Class 12 Accountancy Additional Practice Question Paper 2023-24 with answers.

CBSE Class 12 Accountancy Additional Practice Question Paper 2023-24

The Central Board of Secondary Education has released the Class 12 Additional Practice Question Papers according to the newly updated format. All these Additional Practice Papers consist of the entire syllabus and 50% of the competitive questions. The CBSE Class 12 Additional Practice Question Paper 2023-24 provides an overview of the actual exam pattern, including the number of sections, number of questions, types of questions (Multiple Choice Questions, Short answer questions, and Longer answer Questions), and overall structure of the actual Board Examination. The CBSE Class 12 Accountancy Additional Practice Question Paper 2023-24 consists of a total of 34 questions. All questions are compulsory, as there is no overall choice. However, an internal choice will be provided in 7 questions of one mark, 2 questions of three marks, 1 question of four marks, and 2 questions of six marks.

The question paper is divided into two sections, section A and section B.

- Section – A is compulsory for all the candidates.

- Section – B has two options i.e. (i) Analysis of Financial Statements and (ii) Computerised Accounting. Students must attempt only one of the given options as per the subject opted.

- The questions 01 to 10 and questions 27 to 30 carry 01 mark each.

- Questions 17 to 20 and question 32 are of 03 marks each.

- Questions number 21, 22, and 33 are of 04 marks each.

- Questions 23 to 26 and question number 34 are of 06 marks each.

Class 12 Accountancy Additional Practice Question Paper 2023-24 Pdf

Now the students can download the CBSE Class 12 Accountancy Additional Practice Question Paper 2023-24 pdf along with the answer key and marking scheme. Practicing these Addition Practice Question Papers 2023-24 will help the students to familiarize themselves with the latest Board Exam pattern and the type of questions that can be asked in the main examination.

| CBSE Class 12 Accountancy Additional Practice Question Paper 2023-24 | |

| Class 12 Additional Practice Question Paper 2023-24 Pdf | Solution Pdf |

| Accountancy Additional Practice Question Paper Link | Solution Link |

Accountancy Additional Practice Question Paper 2023-24

Section A

Q1. Accounting Standard-26 requires that goodwill is to be recorded in the books of accounts only when money or money’s worth has been paid for it. At the time of admission, Vivaan, a new partner was unable to bring in his share of goodwill in cash, so according to Accounting Standard-26 his:

(a) Current A/c will be credited

(b) Current A/c will be debited

(c) Capital A/c will be debited

(d) Capital A/c will be credited

Answer: (b) Current A/c will be debited.

Q2. Read the following statements: Assertion (A) and Reason (R). Choose the correct alternative from those given below.

Assertion: Michael, Mike, and Stephen were partners sharing profits and losses in the ratio of 3:2:1. Stephen being a partner wants that he should be exempted from sharing the losses in the firm.

Reasoning: According to the Partnership Act 1932,” It may be agreed between the partners that one or more of them shall not be liable for losses.”

Alternatives:

(a) Both A and R are correct, and R is the correct explanation of A.

(b) Both A and R are correct, but R is not the correct explanation of A.

(c) A is correct but R is incorrect.

(d) A is incorrect but R is correct.

Answer: (a) Both A and R are correct, and R is the correct explanation of A.

Q3. According to Sec 50 of the Companies Act 2013, the amount of Calls in Advance can be accepted by the Company only when it is authorized by:

(a) Board of Directors

(b) Equity Shareholders

(c) Articles of Association

(d) Memorandum of Association

Answer: (c)Articles of Association.

OR

Q3. Tulip Ltd. took up a loan from a Punjab National Bank and issued its’ Debentures as Collateral Security. The bank to whom these debentures are issued:

(a) will be entitled to interest on such debentures.

(b) will not be entitled to interest on such debentures.

(c) will be entitled to interest on primary security.

(d) will not be entitled to interest on loans taken up from the bank.

Answer: (b) will not be entitled to interest on such debentures.

Q4. Danish, Zaid, and Mihir who were sharing profits and losses equally decided to share the future profits and losses in the ratio of 5:4:3 with effect from 1st April 2023. An extract of their Balance Sheet as of 31st March 2023 is:

| Liabilities | Amount | Assets | Amount |

| Investment Fluctuation Reserve | 85,0000 | Investments (At Cost) | 8,00,000 |

At the time of reconstitution, if the market value of the Investment was Rs. 7,06,000, the Revaluation A/c will be:

(a) Debited with 15,000

(b) Debited with 9,000

(c) Credited with 2,000

(d) Credited with 12,000

Answer: (b) Debited with 9,000.

OR

Q4. Sam, Tom, and Jerry were partners sharing profits and losses equally. Sam sold land costing Rs.5,00,000 belonging to the firm, without informing other partners and made a profit of Rs.50,000 on the sale of such land. Which decision should be taken by the firm to rectify this situation?

(a) Sam needs to return only Rs.5,00,000 to the firm.

(b) Sam is required to return Rs.50,000 to the firm.

(c) Sam is required to pay back Rs.50,000 only equally to Tom and Jerry.

(d) Sam needs to return Rs.5,50,000 to the firm

Answer: (d) Sam needs to return Rs.5,50,000 to the firm.

Q5. Mike and Ken were two partners sharing profits and losses in the ratio 4:3. Ken was in need of funds so he took a loan of Rs.50, 000 from the firm at an agreed rate of interest being 10% p.a. If Interest is charged on loan to the partner it will be:

(a) Debited to Profit and Loss A/c

(b) Credited to Profit and Loss A/c

(c) Debited to Profit and Loss Appropriation A/c

(d) Credited to Profit and Loss Appropriation A/c

Answer: (b) Credited to Profit and Loss A/c.

Q6. Cadillac Ltd. allotted 2,000 8% Debentures of Rs. 100 each to their underwriters to pay their commission.

Which of the following journal entry is correct, if 8% Debentures are allotted to underwriters?

(a) 8% Debentures A/c Dr

To Underwriting Commission A/c

(Commission due to them)

(b) 8% Debentures A/c Dr

To Underwriter’s A/c

(Commission due to them)

(c) Underwriter’s A/c Dr

To Underwriting Commission A/c

(Commission due to them)

(d) Underwriter’s A/c Dr

To 8% Debentures A/c

(Commission due to them)

Answer: (d)Underwriter’s A/c Dr

To 8% Debentures A/c

(Commission due to them).

OR

Q6. Which of the following statements is correct about debentures?

(a) Interest on debentures is an appropriation of profits.

(b) Debenture holders are the creditors of a company.

(c) Debentures cannot be issued to vendors at a discount.

(d) Interest is paid on Debentures issued as Collateral Security.

Answer: (b) Debenture holders are the creditors of a company.

Q7. Read the following statements: Assertion (A) and Reason (R). Choose the correct alternative

from those given below.

Assertion (A) :- Under Section 62(1)(b) of the Companies Act, 2013, a Company may offer shares to its employees under a scheme of ‘Employees Stock Option’ which means the option (right) given to the whole-time directors, officers or permanent employees of a company to purchase or subscribe the securities offered by the company at a future date, at a pre-determined

price, which is lower than the market price.

Alternatives:

Reason (R):- The company need not pass a special resolution to this effect.

(a) Both Assertion (A) and Reason (R) are correct and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are correct, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is incorrect, but Reason (R) is Correct.

(d) Assertion (A) is correct, but Reason (R) is incorrect.

Answer: (d) Assertion (A) is correct, but Reason (R) is incorrect.

Q8. Neil, Nitin, and Nitesh were partners in the firm sharing profits and losses equally. Neil retires from the firm and on his retirement, he is entitled to the payment due to him after all the adjustments.

At the time of retirement, if nothing is mentioned about the payment made due to him, in which account, the amount will be transferred:

(a) Retiring Partner’s Current A/c

(b) Retiring Partner’s Capital A/c

(c) Retiring Partner’s Loan A/c

(d) Retiring Partner’s Bank A/c

Answer: (c) Retiring Partner’s Loan A/c.

OR

Q8. Stella, Grace, and Carol were partners in the firm sharing profits and losses in the ratio 3:2:1.

Carol was guaranteed a profit of 15,000 after making all adjustments. Any deficiency is to be borne by Grace. The net profit for the year 31st March 2023 was Rs.60,000. Grace will be ________ by Rs.________.

(a) Credited, Rs.6,500.

(b) Debited, Rs.5,000.

(c) Credited, Rs.7,500.

(d) Debited, Rs. 2,500.

Read the following hypothetical situation and answer questions no. 9 and 10.

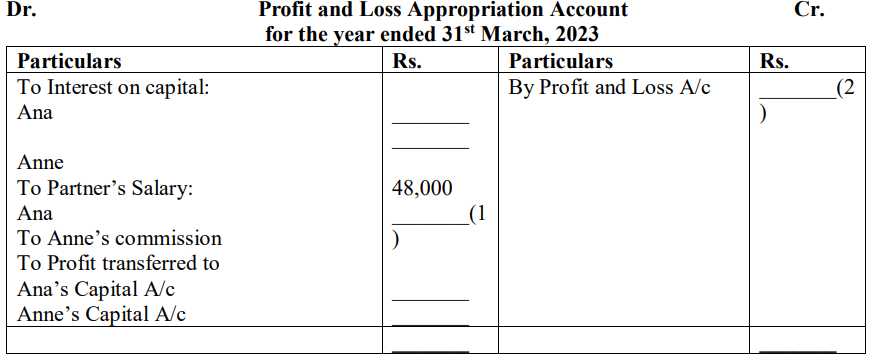

Ana and Anne started a partnership business on 1st April 2022. Their capital contributions were Rs. 3, 00,000 and Rs. 1, 00,000 respectively. Ana rented her property to carry on business for Rs.2, 500 p.m. Interest on capital @12% p.a. Ana, to get a salary of Rs. 4,000 p.m. Anne to get a commission of 2% of the net profit. Profits are to be shared in the ratio of 3:2. The profits for the year ended 31st March 2023 before providing for rent was Rs. 2, 00,000.

Answer: (b) Debited, Rs.5,000.

Q9. The amount to be reflected in the blank (1) will be:

(a) Rs.3,720

(b) Rs.3,400

(c) Rs. 2,800

(d) Rs.2,940

Answer: (b) Rs.3,400.

Q10. The amount to be reflected in the blank (2) will be:

(a) Rs.1,62,000

(b) Rs. 1,74,500

(c) Rs. 1,71,400

(d) Rs.1,70,000

Answer: (d) Rs.1,70,000

Q11. Which of the following is the right of a partner?

(a) sharing profits and losses with other partners in the agreed ratio

(b) inspecting and having a copy of the books of accounts

(c) retiring from the firm without giving proper notice

(d) taking part in the misconduct of the business

Choose the correct option:

(i) Only (b) and (c)

(ii) Only (c)

(iii) Only (a) and (b)

(iv) Only (a) and (d)

Answer: (iv) Only (a) and (d)

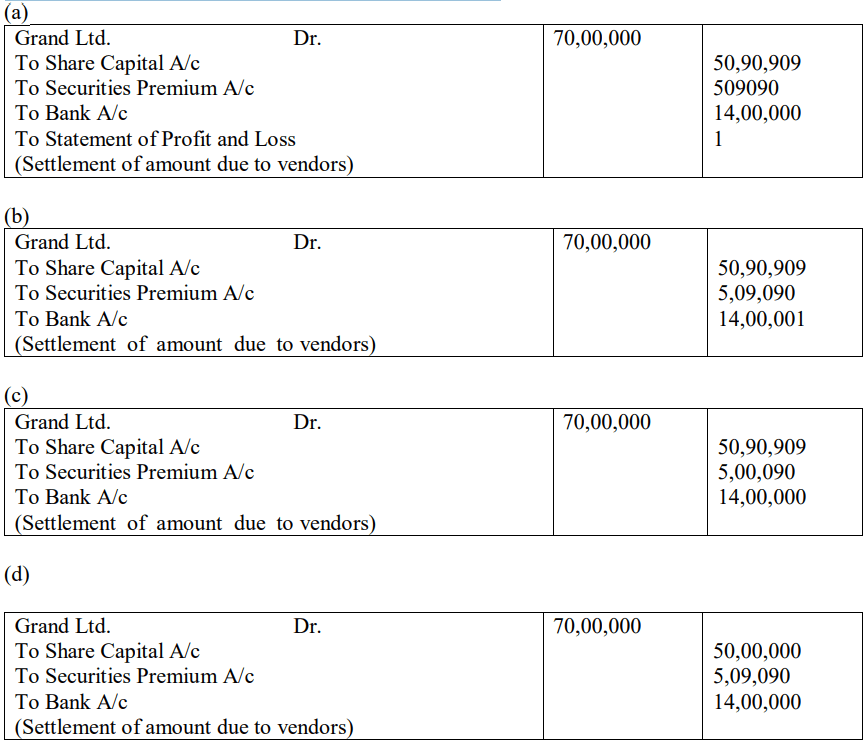

Q12. . Skyline Ltd. took over running business worth Rs. 70,00,000 from Grand Ltd. by paying 20% through bank draft and balance by issuing shares of Rs.100 each at a premium of 10%. The entry to be passed by Skyline Ltd for settlement will be:-

Answer: (b)

Q13. Mayfair Ltd. forfeited 2,000 shares of Rs.10 each, Rs.7 called up, on which only Rs. 4 per share (including Rs.2 premium) and Rs.2 per share on first call has not been paid. Out of these 500 shares were re-issued as fully paid that Rs. 750 was transferred to Capital Reserve. On reissue, how much amount will be transferred to Bank A/c?

(a) Rs. 3,250

(b) Rs. 4,250

(c) Rs. 2,250

(d) Rs. 5,500

Answer: (b) Rs. 4,250

14. David and Garry are partners in a firm with capitals of Rs. 90,000 and Rs. 80,000 respectively. Zenith brings Rs.70,000 as his capital for 1/4th share in profits. Zenith’s share of goodwill will be:

(a) Rs. 34,000.

(b) Rs. 29,000.

(c) Rs.10,000.

(d) Rs.14,000.

Answer: (c) Rs.10,000.

Q15. 15. Edward and Hayward are partners. Edward draws a fixed amount at the beginning of every quarter. Interest on drawings is charged @10% p.a. At the end of the year, interest on Edward’sMdrawings amounted to Rs.7,500. Drawings of Edward were:

(a) Rs. 34,000 per quarter.

(b) Rs. 44,000 per quarter

(c) Rs. 30,000 per quarter

(d) Rs. 60,000 per quarter

Answer: (c) Rs. 30,000 per quarter

OR

Q15. Ayan, Azan, and Aqib are partners carrying on the furniture business. Ayan withdrew Rs. 5,000 at the end of each month. Azan withdrew Rs.10,000 at the end of each quarter. Aqib withdrew Rs.40,000 at the end of each month for six months. The partnership deed provides for interest on drawings @ 12% p.a. The interest on drawing charged from Ayan, Azan, and Aqib at the end of the year will be:

(a) Ayan- Rs. 1,800, Azan- Rs.3,300, Aqib- Rs. 6,000

(b) Ayan- Rs. 2,400, Azan- Rs. 1,200, Aqib- Rs. 5,000

(c) Ayan- Rs. 1,400, Azan- Rs. 3,200, Aqib- Rs. 2,000

(d) Ayan- Rs. 3,200, Azan- Rs. 2,300, Aqib- Rs. 8,000

Answer: (a) Ayan- Rs. 1,800, Azan- Rs.3,300, Aqib- Rs. 6,000.

Q16. At the time of dissolution, Harry, a creditor of the firm agreed to take over the furniture of the book value of Rs. 1, 00,000 at Rs. 89,000 and the balance in cash in full settlement of his account of Rs.1, 10,000.

Which journal entry will be passed for the balance to be paid in cash?

(a) Realisation A/c Dr. 35,000

To Bank A/c 35,000

(b) Realisation A/c Dr. 21,000

To Bank A/c 21,000

(c) Realisation A/c Dr. 11,000

To Bank A/c 11,000

(d) Realisation A/c Dr. 15,000

To Bank A/c 15,000

Answer: (b)

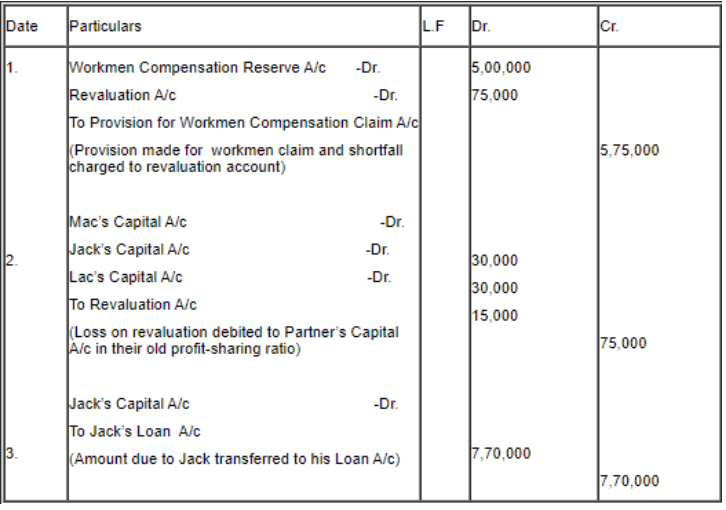

Q17. Mac, Jack, and Lac were partners in a firm sharing profits and losses in the ratio of 2:2:1

Workmen’s Compensation Reserve 5,00,000

On Jack’s retirement from the firm on 1st April 2023, he had a balance of Rs.8, 00,000 (cr.) in his capital account. The liability of Workmen’s Compensation Reserve was Rs. 5, 75,000. You are required to pass journal entries and show how much amount is transferred to his loan account.

Answer:

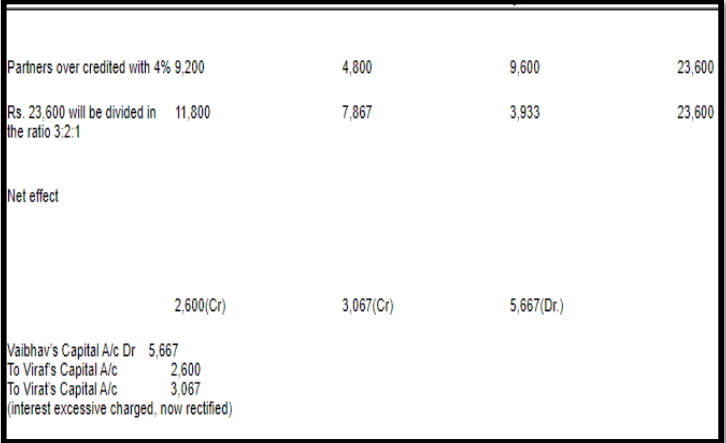

Q18. Viraf, Virat, and Vaibhav were partners with a capital of Rs 2,30,000, Rs 1,20,000, and Rs.2,40,000. After distributing the profit of 5,20,000 for the year ended 31st March 2023 in their agreed ratio of 3:2:1 it was observed that:

Interest on capital was provided at 14% p.a. instead of 10% p.a. You are required to pass an adjustment entry.

Answer:

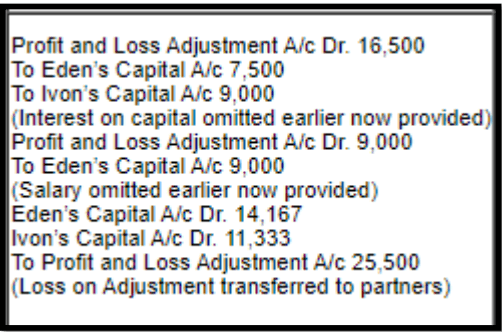

OR

Q18. Eden and Ivon were partners in a firm sharing profits and losses in the ratio of 5:4. Their capitals were Rs.75,000 and Rs. 90,000 respectively. After the accounts for the financial year ending March 31, 2023, have been prepared, it is observed that interest on capital @ 10% per annum and salary to Eden @ Rs.9,000 per annum, as provided in the partnership deed has not been credited to the partners’ capital accounts before distribution of profits. You are required to give necessary rectifying entries using the Profit and Loss Adjustment Account.

Answer:

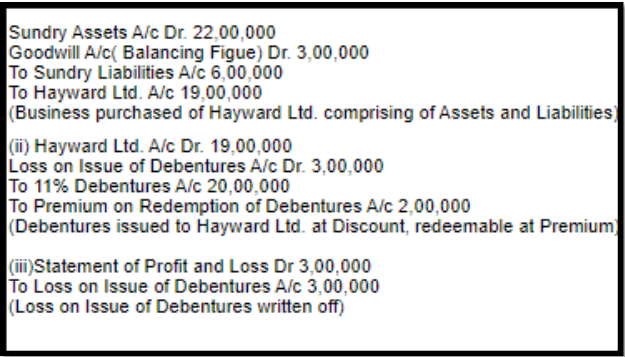

Q19. Glen Ltd. took over the running business of Hayward Ltd. having assets of Rs.22,00,000 and liabilities of Rs.6,00,000 by issuing 20,000, 11% Debentures of Rs. 100 each at a 5% discount. You are required to pass the journal entries in the books of Glen Ltd. if debentures were redeemed at a 10% premium.

Answer:

OR

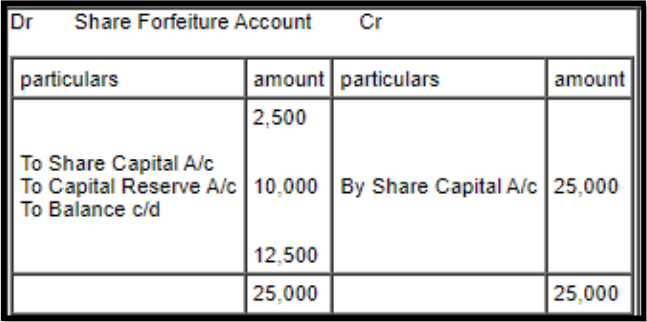

Q19. Frank Ltd. issued 1,00,000 Equity shares of Rs. 10 each. The amount was duly received except for 5,000 Equity shares on which Rs. 5 per share was received. These shares were forfeited and 2,500 Equity shares were reissued for Rs. 9 each fully paid up. You are required to prepare a Share Forfeiture Account.

Answer:

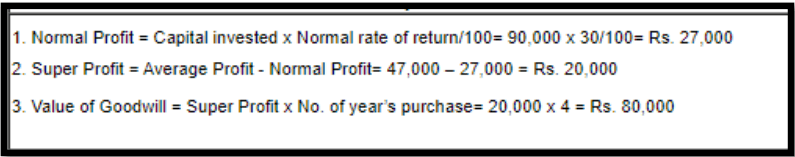

Q20. . Kate and Vincent were partners in a firm. On 1st April 2022, the firm had assets of Rs.90,000 including cash of Rs. 8,000. The partners’ capital accounts showed a balance of Rs. 70,000 and reserves constituted the rest. The normal rate of return is 30% and the average profits of the firm are valued at Rs. 47,000.

You are required to find out the value of goodwill of the firm at 4 years’ purchase of super profits.

Answer:

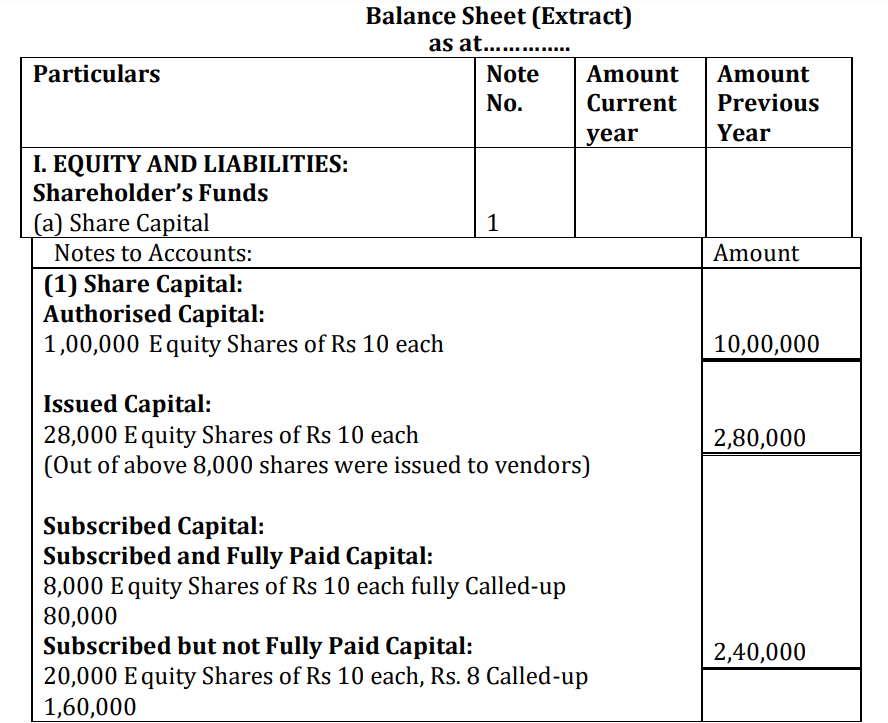

Q21. K le n Ltd. was registered with an authorized capital of R s. 1 0,00,000 divided into Equity Shares of Rs 10. Out of these 8,000 shares were issued to vendors as fully paid as purchase consideration for a business acquired. The company offered 20,000 shares for public subscription and called up Rs.8 per share and received the entire amount.. You are required to prepare the Balance Sheet of the company as per Schedule III of the Companies Act, 2013, showing the Share Capital balance and also preparing Notes to Accounts.

Answer:

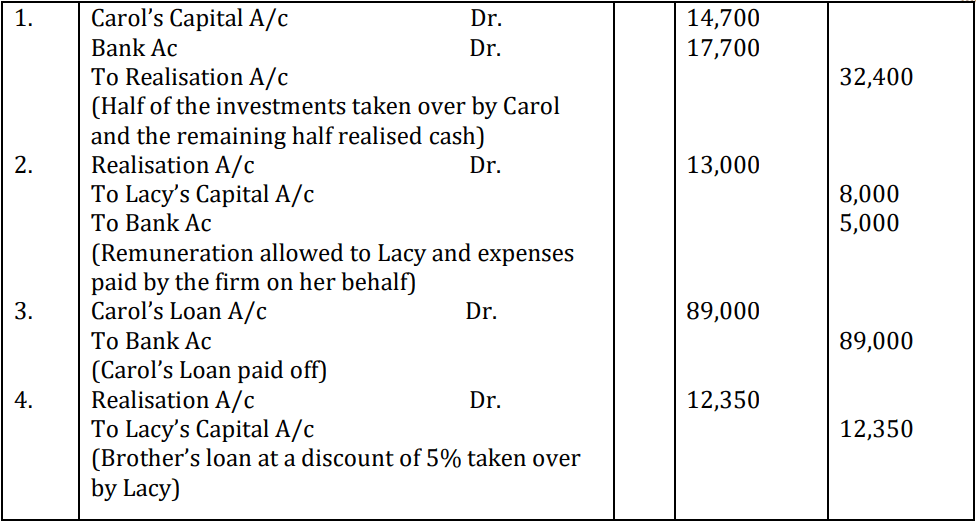

Q22. Carol and Lacy were partners. They decided to dissolve their firm. Pass the journal entries for the following after various assets and external liabilities have been transferred to Realisation A/c:

1. Carol took over half of the investments worth Rs. 30,000 at a 2% discount and the remaining investments were sold at a profit of 18% of the book value.

2. Lacy is allowed a remuneration of Rs. 13,000 for dissolution work and is to bear all the expenses of realization which amounted to Rs. 5,000 were paid by the firm.

3. Carol had given a loan of Rs. 89,000 to the firm which was duly paid.

4. Lacy agreed to pay off her brother’s loan of Rs. 13,000 at a discount of 5%.

Answer:

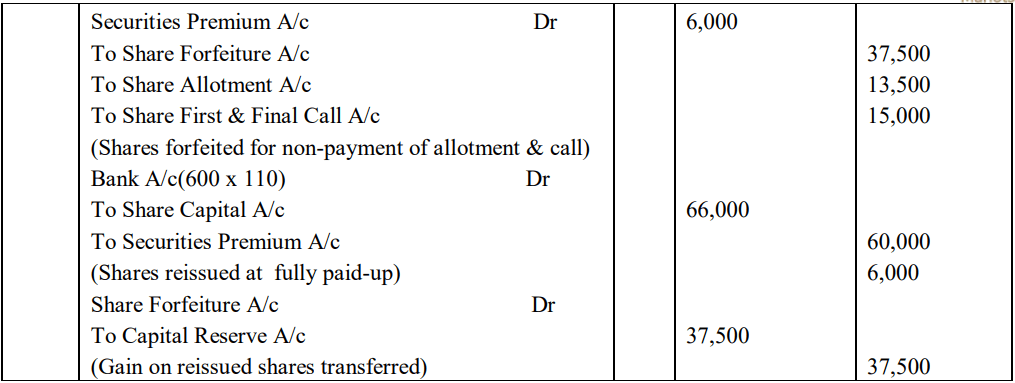

Q23. Royal Fans Ltd. invited applications for 1,00,000 Equity Shares of Rs.100 each at a premium of 10%. The amount was payable as follows:

On Application Rs. 50 per share

On Allotment Rs. 35 per share (including premium)

On the First and Final Call Rs. 25 per share

Applications for 1,50,000 shares were received. Applicants for 25,000 shares did not get any allotment and their money returned. The allotment was made pro-rata to the remaining applicants.

Excess application money was adjusted towards the sum due on allotment. Mr. Hanoz who was allotted 600 shares failed to pay the amount due on allotment and call money. The company forfeited his shares and subsequently re-issued them at Rs 110 per share fully paid up.

You are required to pass journal entries to record the above transactions in the books of the company.

Answer:

Working notes:

Mr. Hanoz has been allotted 600 shares

If shares allotted were 600, shares applied for were = 1,25,000/1,00,000 x 600 = 750 shares Excess Application money received from Mr. Hanoz:

750 shares – 600 shares = 150 shares x Rs. 50 = Rs. 7,500

Amount due from Mr. Hanoz on Allotment:

600 shares x Rs. 35 = Rs. 21,000

Less:- Excess received on application from Mr. Hanoz = Rs. 7,500

Net amount due from Mr. Hanoz, not been received = Rs. 13,500

Total amount due on allotment 1,00,000 x Rs. 35 = Rs. 35,00,000

Less:- Excess received on applications = Rs. 12,50,000

Less:- Amount not been received from Mr. Hanoz = Rs. 13,500

The net amount received on the allotment in cash = Rs. 22,36,500

OR

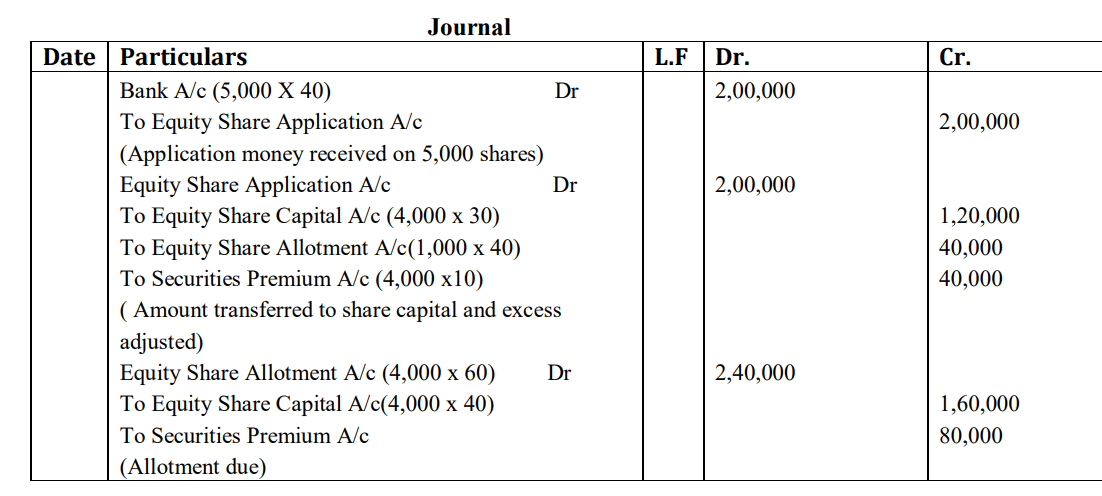

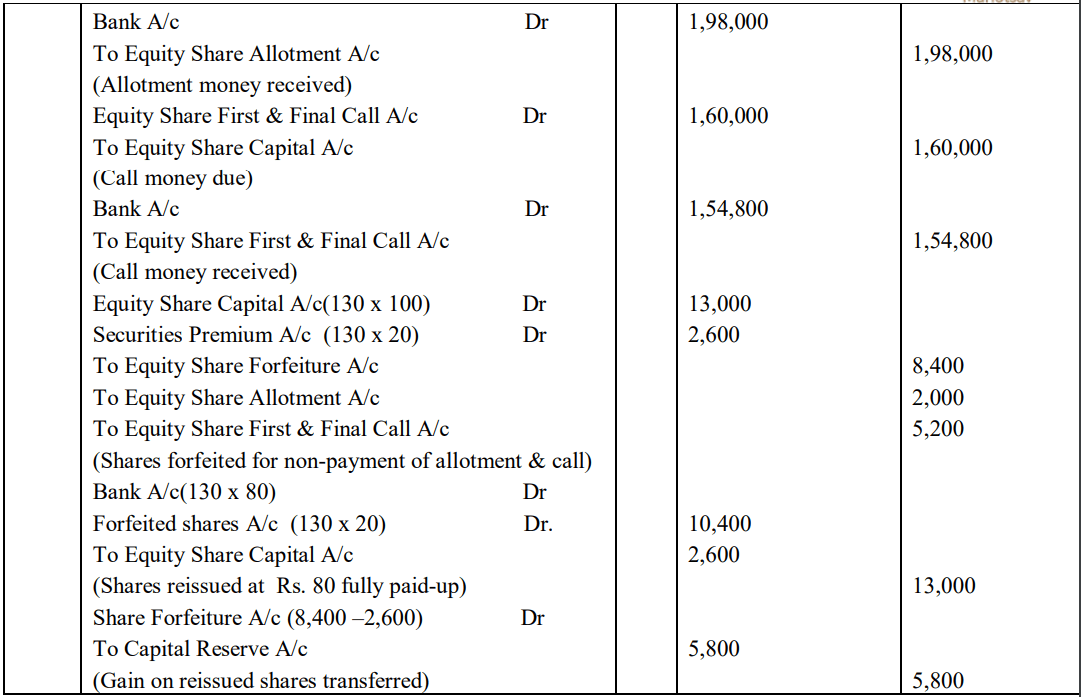

Q23. Phizer Ltd. invited applications for 4,000 equity shares of Rs 100 each at a premium of 30 per share. The amount was payable as follows:

On Application Rs. 40 (Including premium Rs 10)

On Allotment Rs. 60 (Including premium Rs 20)

On the First and Final Call Rs. 40

Applications for 5,000 shares were received. The allotment was made to all the applicants on a pro-rata basis. Excess application money was adjusted towards the sum due on allotment. Rocky, to whom 40 shares were allotted, failed to pay the allotment and call money. Ali, to whom 90 shares were allotted, failed to pay the call money. These shares were forfeited. The forfeited shares were re-issued @ Rs 80 per share fully paid up.

You are required to pass journal entries to record the above transactions in the books of the company.

Answer:

Working notes:

1. Excess application money adjusted on allotment =(5,000 – 4,000) x Rs 40=Rs 40,000

2. Amount not received from defaulter shareholders:

Calculation for Rocky

Shares allotted to Rocky=40

Shares applied for by Rocky=40 x 5,000/4,000=50

Application money received =50 x 40=2,000

Application money due on shares allotted =40 x 40= 1,600

Excess Application money adjusted on allotment-Rs 2,000-Rs.1,600=Rs 400

Allotment money due on shares allotted = 40 x 60=2,400

Allotment money due but not received (Calls-in-Arrears) Rs. 2,400-Rs 400=Rs 2,000

Call money due but not received = 40 x 40 = Rs 1,600

Calculation for Ali

Shares allotted to Ali = 90

Call money due but not received = 90 x 40 = Rs 3,600

3. Calculation of amount received on allotment later on:

Total allotment money due (4,000x Rs. 60) =Rs.2,40,000

Less: Excess application money adjusted (WN 1) = Rs.40,000 = 2,00,000

Less: Allotment money due but not received (WN 2) = Rs.2,000

The amount received on Allotment = Rs. 1,98,000

3. Calculation of the amount received on the first and final Call later on:

Total first and final Call money due (4,000 x Rs. 40) =Rs.1,60,000

Less: first and final Call money due but not received [3,600+1,600] = Rs.5,200

The amount received on the first and final Call = Rs. 1,54,800

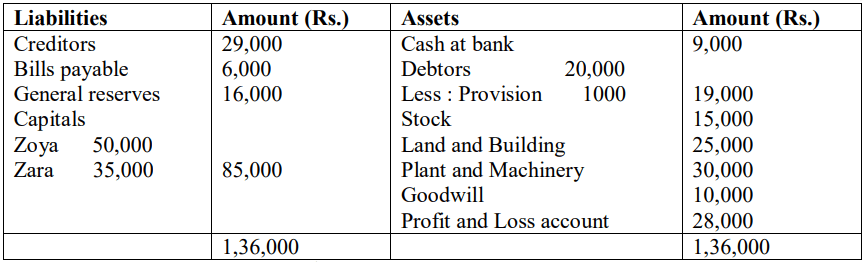

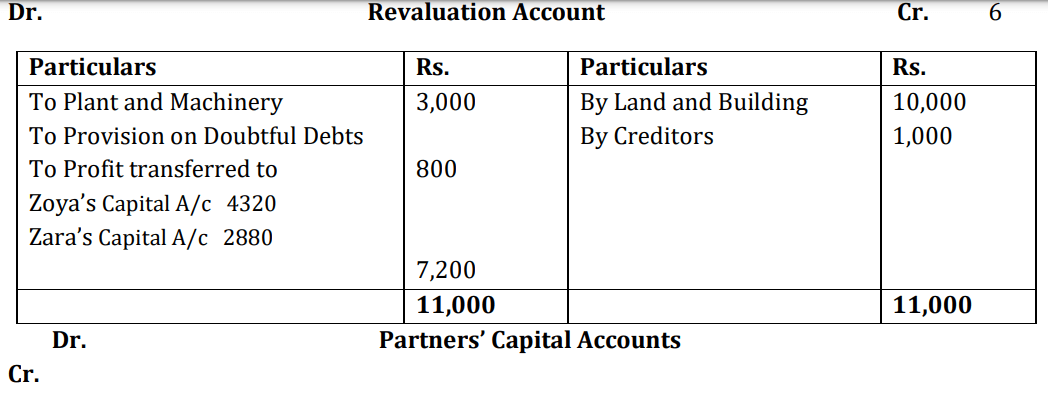

Q24. On 31st March 2023, the Balance sheet of Zoya and Zara who were sharing profits and losses in the ratio of 3:2 was as follows.

They decided to admit Sara for 1/5th share on 1st April 2022 in the firm on the following terms:

(a) The goodwill of the firm is valued at Rs 28,000.

(b) Depreciate Plant and Machinery by 10%, appreciate Land and Building by 40%.

(c) The provision for doubtful debts was to be increased by Rs. 800.

(d) A liability of Rs. 1,000 included in the creditors is not likely to arise.

(e) The New profit-sharing ratio between Zoya, Zara, and Sara shall be 5:3:2 respectively.

(f) Sara was to contribute capital equal to 1/5th of the total capital of Zoya and Zara after all adjustments.

You are required to prepare the Revaluation Account and Partners’ Capital Accounts.

Answer.

Notes to the solution:

1. The goodwill of the firm is valued at Rs 28,000.

Sara’s share of goodwill = 28,000 x 1/5 = 5,600

Sacrificing Ratio=Old ratio – New ratio

Zoya = 3/5 – 5/10 = 1/10

Zara = 2/5 – 3/10 = 1/10

1:1

2. Calculation of Sara’s Capital:

Combined capitals of Zoya and Zara = 43,920+31,880 = 75,800

Sara’s Capital = 75,800 x 1/5 =15,160

2 marks for Revaluation A/c

2 marks for Partners’ Capital Accounts

2 marks for Notes on the solution.

OR

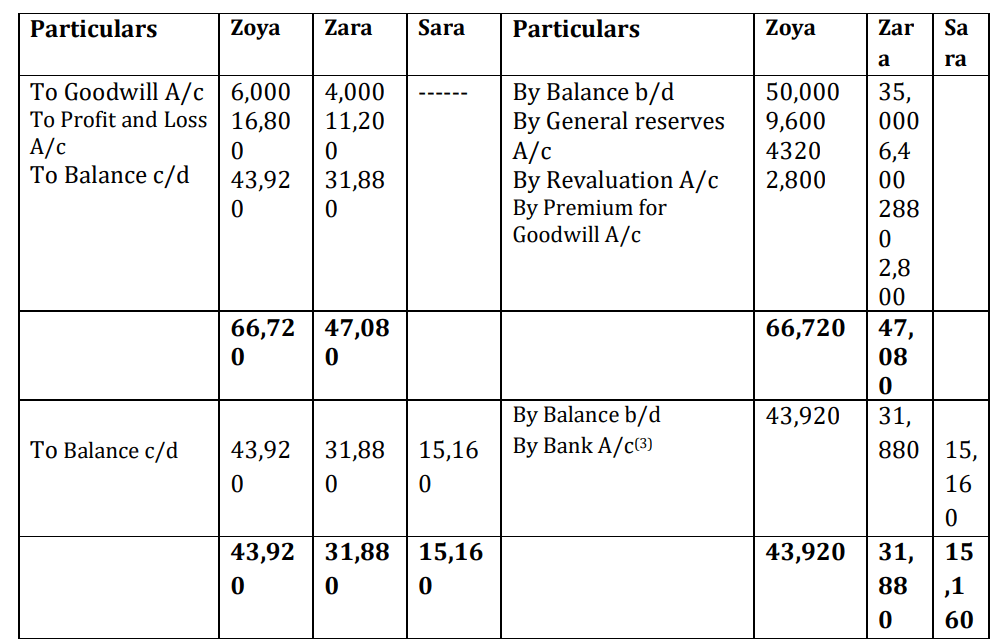

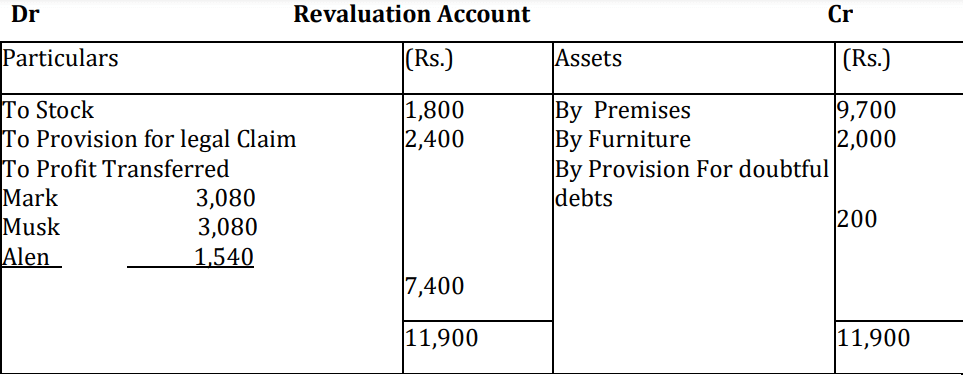

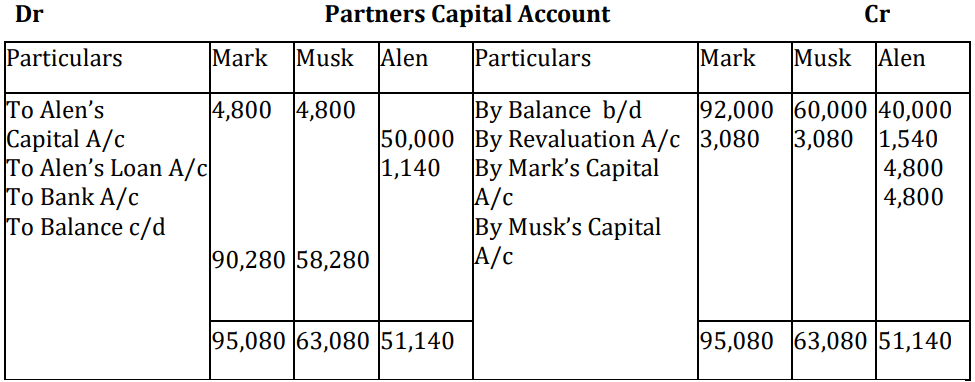

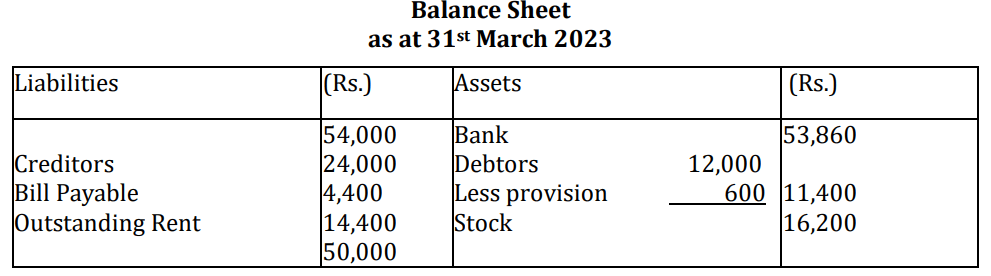

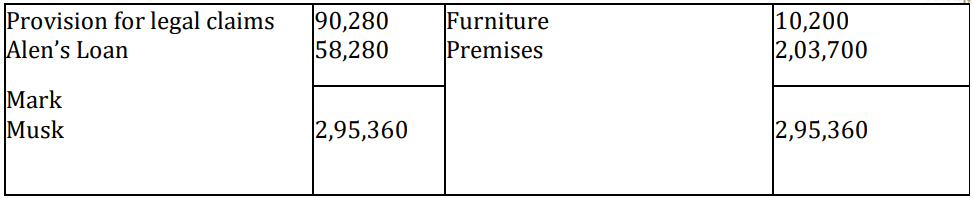

Q24. Mark, Musk, and Alen were partners in a firm sharing profits in a 2:2:1 ratio, On 31.3.2023 Alen retired from the firm. On the date of Alen’s retirement, the Balance Sheet of the firm was as follows:

On Alen’s retirement, it was agreed that:

(a) Premises will be appreciated by 5%.

(b) Furniture will be appreciated by Rs. 2,000.

(c) Stock will be depreciated by 10%.

(d) Provision for bad debts was to be made at 5% on debtors.

(e) Provision of legal damages to be made for Rs. 14,400.

(f) Goodwill of the firm is valued at Rs. 48,000.

(g) Rs. 50,000 from Alen’s Capital A/c will be transferred to his Loan A/c and the balance will be paid by cheque.

Prepare Revaluation A/c, Partners Capital A/c’s, and Balance Sheet of Mark and Musk after Alen’s Retirement.

Answer:

Working Note:

1. New Provision of bad debts on debtors (5%) = 5% of Rs. 12,000 = 600 provision Rs. 800 as given in the balance Sheet. Excess of Rs. 200 is profit transferred to revaluation A/c

2. Goodwill of the firm = 48,000

Alen’s share = 48,000x 1/5=Rs. 9,600 be given to Mark and Musk in Gaining Ratio i.e. 1:1.

Goodwill contributed by Mark = = Rs. 4,800.

Goodwill contributed by Musk = = Rs. 4,800.

3. Alen’s total amount due on retirement = Rs 51,140

Less: amount transferred to his loan A/c = Rs. 50,000

Amount to be paid by cheque = Rs. 1,140

2 marks for Revaluation A/c

2 marks for Partners’ Capital Accounts

2 marks for Balance Sheet.

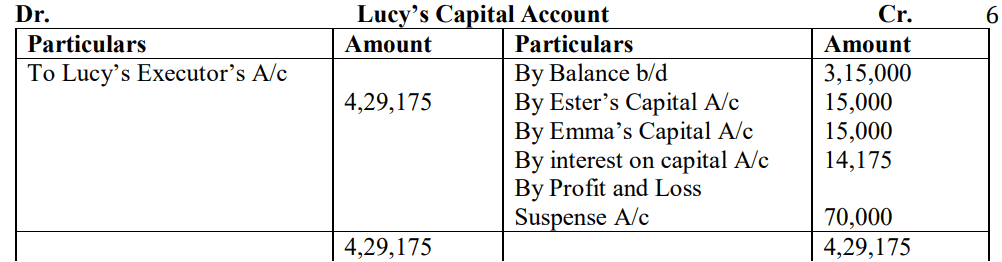

Q25. Ester, Emma, and Lucy were partners in a firm sharing profits in the ratio of 2: 2: 1. The firm closes its books on 31st March every year. On 30th September 2022, Lucy died. The partnership deed provided that on the death of a partner her executors will be entitled to the following:

(a)Balance in her capital account which amounted to Rs. 3,15,000 and interest on capital @9%.

(b)Her share in the profits of the firm till the date of her death amounted to Rs.70,000.

(c) Her share in the goodwill of the firm. The goodwill of the firm on Lucy’s death was valued at Rs. 1,50,000.

You are required to calculate the amount to be transferred to Lucy’s Capital A/c.

Answer:

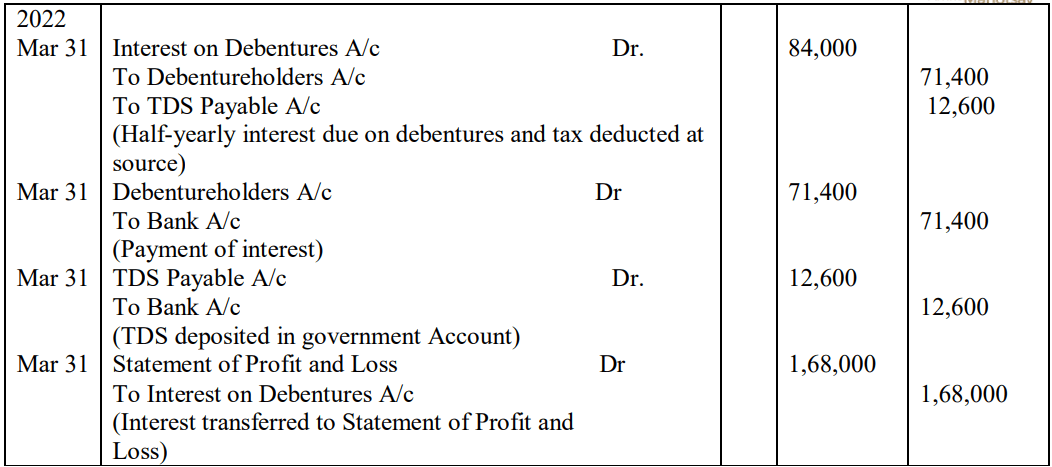

Q26. Akon Ltd issued 12,000, 14% debentures of Rs 100 each on 1st April 2021. The issue was fully subscribed. According to the terms of the issue, interest on debentures is payable half-yearly on 30th September and 31st March and tax deducted at source is 15%.

You are required to pass the necessary entries related to the debenture interest for the half-yearly ending on 31st March 2022 and transfer of interest on debentures to the statement of profit and loss.

Answer:

Section B

Q27. Operating Cycle is the time between the acquisition of assets for processing and their realisation into:

(a) Current Assets

(b) Non- current Assets

(c) Other Current Assets

(d) Cash and Cash Equivalents

Answer: (d) Cash and Cash Equivalents

OR

Q27. Interest Accrued but not Due on Debentures will be shown under the heading:

(a) Current Assets

(b) Current Liabilities

(c) Contingent liability

(d) Non-current Assets

Answer: (b) Current Liabilities.

Q28. Vibgyor Ltd. has current assets worth Rs. 3,50,000 and it needs to pay off its obligations worth Rs.2,00,000. If the firm has to make a payment of a current liability worth Rs. 50,000, what will be the current ratio:

(a) 3:1

(b) 0.75:1

(c) 1:1

(d) 2:1

Answer: (d) 2:1

Q29. Statement I: An increase in provision for doubtful debts should be added back for calculating cash from operations.

Statement II: The dividend received is a Financing Activity.

(a) Statement I is correct and Statement II is incorrect

(b) Statement I and II is correct

(c) Statement I and Statement II is incorrect

(d) Statement I is incorrect, and Statement II is correct.

Answer: (a)Statement I is correct and Statement II is incorrect.

OR

Q29. A decrease in Bank Overdraft is shown under which heading in a Cash Flow Statement?

(a) Operating

(b) Financing

(c) Investing

(d) Cash and Cash Equivalent

Answer: (b) Financing

Q30. Prayas Ltd. made a profit of Rs. 1,75,000 after considering the following items:

(i) Goodwill written off Rs. 6,000

(ii) Depreciation on Furniture Rs.3,400

(iii) Loss on sale of Building Rs. 89,000

(iv) Gain on sale of Land Rs. 4,250

Operating Profit before Working Capital changes will be:

(a) Rs. 2,25,149

(b) Rs. 2,69,150

(c) Rs. 2,35,160

(d) Rs. 2,53,145

Answer: (b) Rs. 2,69,150

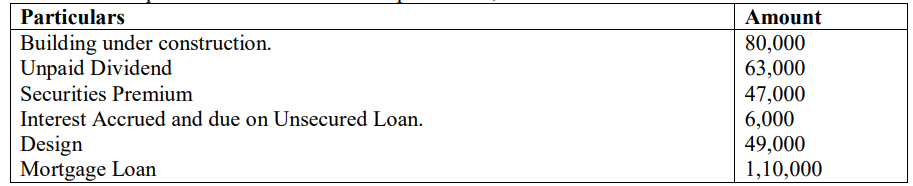

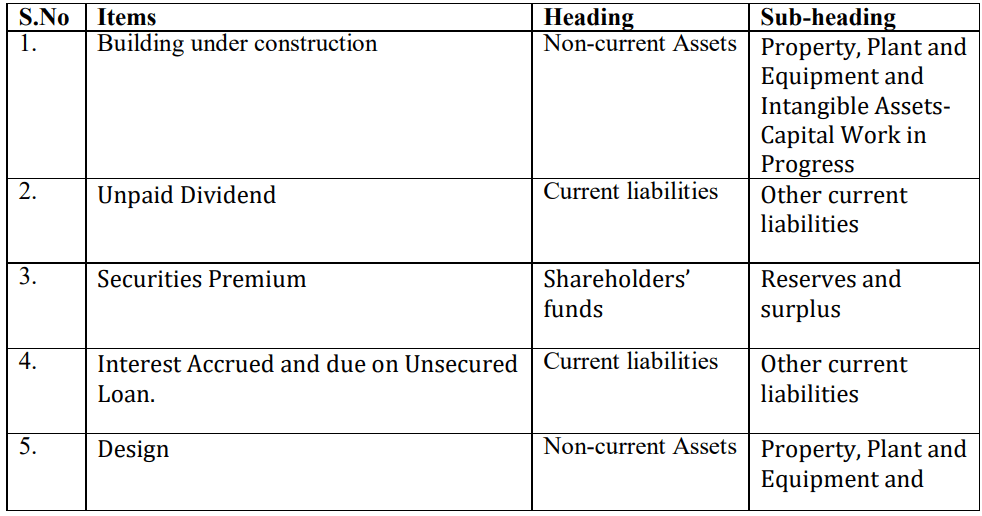

Q31. Classify the following items under Major heads and Subheads (If any) in the Balance Sheet of Beltek Ltd. as per Schedule III of the Companies Act, 2013.

Answer:

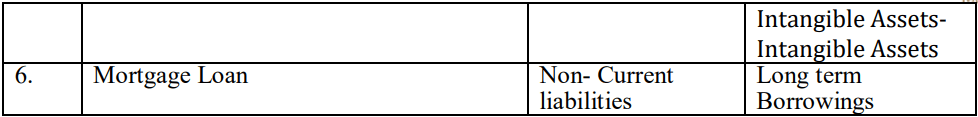

Q32. Following is the Balance Sheet of Yorkshire Ltd. as of 31st March, 2023.

You are required to calculate:

(i) Debt to Equity Ratio

(ii) Current Ratio

(iii) Return on Investment

Answer: (i) Debt to Equity Ratio = Debt/ Equity

Debt to Equity Ratio = 60,000/2,12,800 = 0.28:1

(ii) Current Ratio = Current assets/ Current liabilities

Current Ratio = 85,600/42,000 = 2.03:1

(iii) Return on Investment = Net Profit before Interest and Tax/ Capital Employed x 100

Return on Investment = 2,800+ 7,200(60,000 x 12%) / 2,72,800 x 100

Return on Investment = 10,000/2,72,800 x 100 = 3.66%

1 mark each

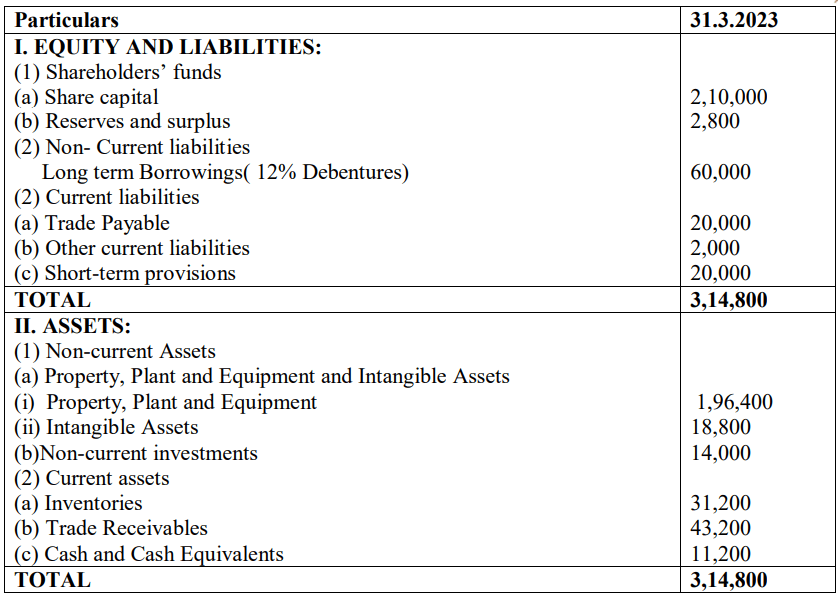

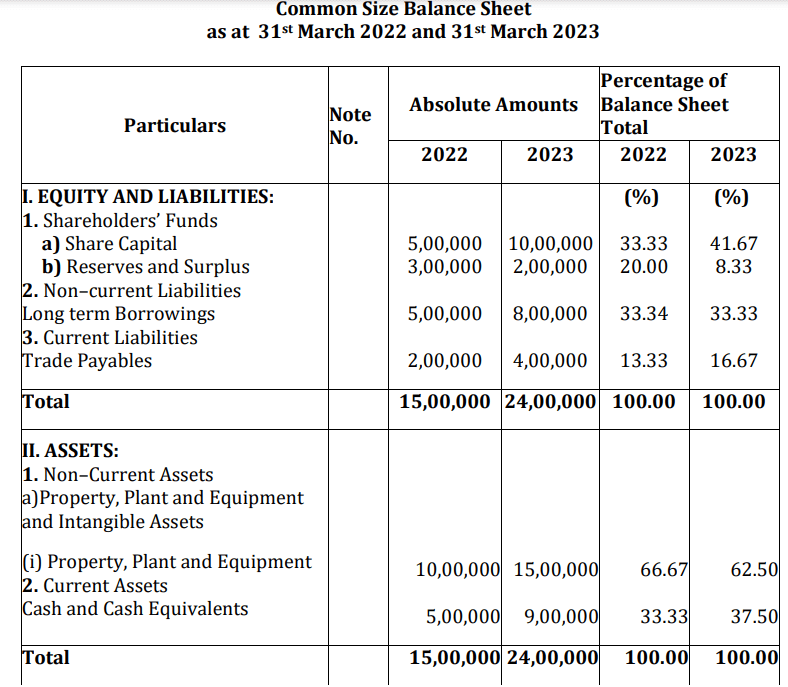

Q33. Following is the Balance Sheet of Meridian Ltd. as at 31st March 2022 and 31st March 2023.

Answer:

OR

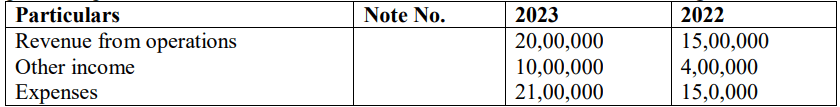

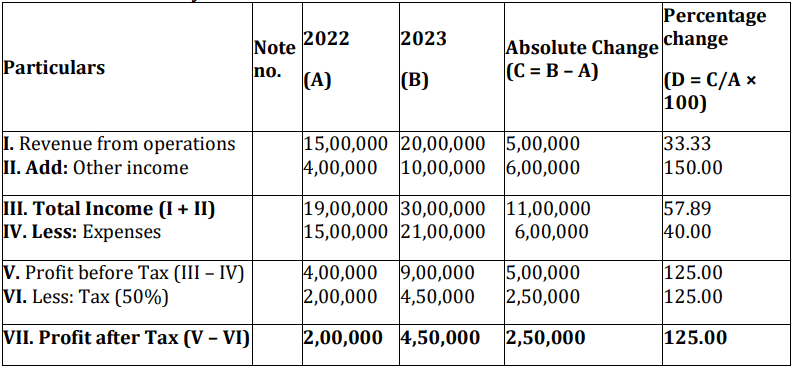

Q33. Prepare a Comparative Statement of Profit and Loss of Gem Ltd. from the following:

The rate of income tax was 50%.

Answer: Comparative Statement of Profit and Loss of Gem Ltd for the year ended 31st March 2022 and 31st March 2023.

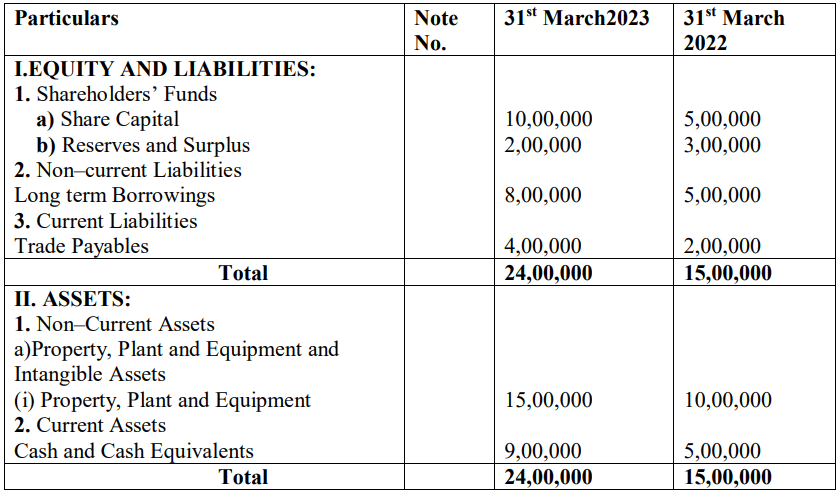

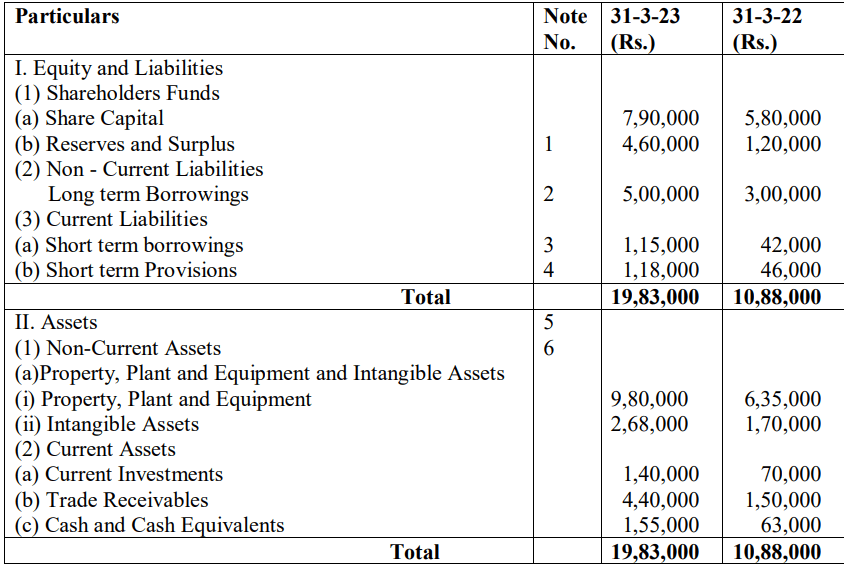

Q34. From the following Balance Sheet of Havels Ltd., you are required to prepare a Cash Flow Statement:

Havels Ltd.

Balance Sheet as at 31-3-2023

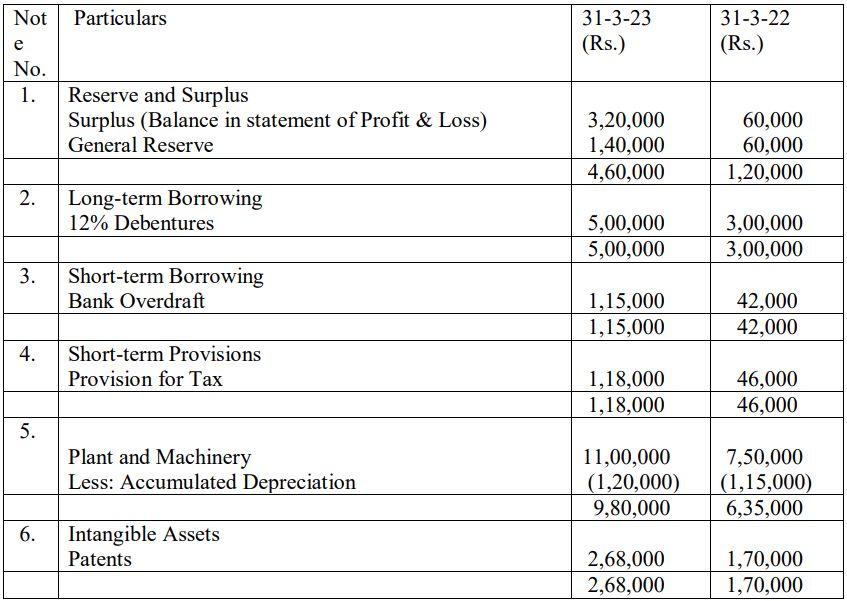

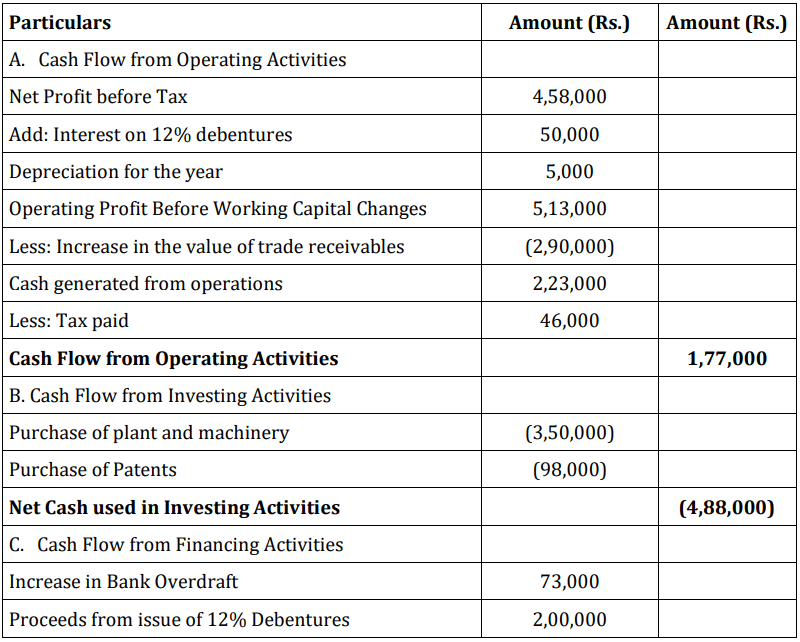

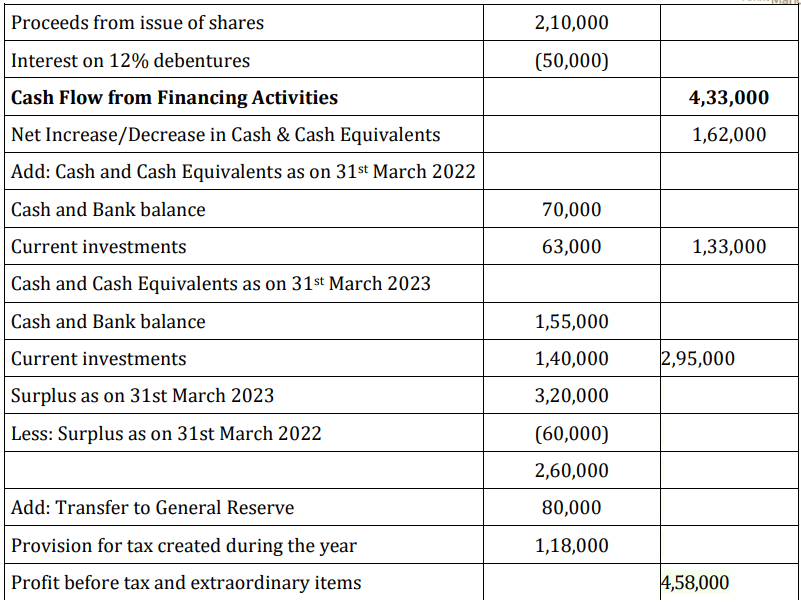

Notes to Accounts:

Additional Information:

12% debentures were issued on 1st September 2022.

Answer: Cash Flow Statement of Havels Ltd

CBSE Class 12 Chemistry Additional Pract...

CBSE Class 12 Chemistry Additional Pract...

CBSE Class 12 Business Studies Sample Qu...

CBSE Class 12 Business Studies Sample Qu...

CBSE Class 12 Physics Model Paper 2024-2...

CBSE Class 12 Physics Model Paper 2024-2...